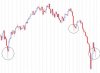

^ You are investing in the US at the moment? Man, big ballz! Not only is their market in worse shape than there, but their dollar aint looking too good either!

Isn't that THE time to be investing in the US Market?

Our Market is still in a very good shape but the honeymoon is almost certainly over. The fact that it will take the US a few years to recover means there are some really good bargains to be had. Just look at Apple & Intel.

I've started looking to the US for Property and Stocks. The more negative sentiments I hear about the US Market, the more keen I am to invest into it. Our market on the other hand, has reached it's highs and although it should get back most, if not all of the recent losses, it doesn't have much to offer than a lot of big expensive, holes in the ground.

.. I'm simply a mug.. have no real experience to speak of.. unless losing cash in the '87 crash counts..

.. I'm simply a mug.. have no real experience to speak of.. unless losing cash in the '87 crash counts..