Steve, maybe as well as trying to improve your exits you need to look at having a re-entry method?

This is something I'm trying to develop atm, as on review of a lot of my trades I'm getting stopped out by a few cents only for the trade to then move in the right direction. The re-entry won't be under the same set up that triggered the original trade but more of a general entry based on the original pattern holding up.

In their book 'Computer Analysis Of The Futures Markets', LeBeau and Lucas outline a strategy for re-entering after you've been prematurely stopped out of a trend.

It's simply to wait for a day on which 3 period RSI climbs back above the 50 level, then you buy above that day.

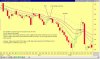

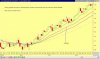

Here's a WFMI chart to show some examples.