- Joined

- 29 June 2007

- Posts

- 467

- Reactions

- 0

The DOW rally last night was what I was looking for. Not sure how sustainable it is but it's got to be good for a few 5-10% swing trades at least.

I just have to narrow it down to the most likely opportunities, but I have a ton of possibilities:

ALZ ARU BMN EHL EWC GIR ICN JML MCR MRM MTN NOD PAN PEM PNA PSA TAP.

To name a few.

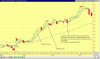

For what it's worth, I dug up this old swing chart set up which I haven't used for ages and only ever used loosely anyway. These days I mostly get by with the Stochastic.

The trrigger is:

1. 10 day SMA is above 20 day SMA, are above 50 day SMA

2. 3 day MA of the Force Index is below zero

13 day MA of the Force Index is above zero

3. D+ is greater than D-

4. ADX is above 25

I just have to narrow it down to the most likely opportunities, but I have a ton of possibilities:

ALZ ARU BMN EHL EWC GIR ICN JML MCR MRM MTN NOD PAN PEM PNA PSA TAP.

To name a few.

For what it's worth, I dug up this old swing chart set up which I haven't used for ages and only ever used loosely anyway. These days I mostly get by with the Stochastic.

The trrigger is:

1. 10 day SMA is above 20 day SMA, are above 50 day SMA

2. 3 day MA of the Force Index is below zero

13 day MA of the Force Index is above zero

3. D+ is greater than D-

4. ADX is above 25