Purple XS2

Yamaha 650 XS2

- Joined

- 14 May 2007

- Posts

- 445

- Reactions

- 109

Re: POTENTIAL BREAKOUT Alerts

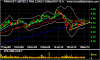

RHM - Richmond Mining

Fundamentals are good, but I would suggest that from a pure chartist perspective, this qualifies as a potential breakout? Sequence of higher lows, and if we regard the high of the October 2009 spike as an anomaly, then also higher highs?

Disclosure: I hold.

Disclosure: I am not, nor have I ever been, a pure chartist, so I don't speak the language.

RHM - Richmond Mining

Fundamentals are good, but I would suggest that from a pure chartist perspective, this qualifies as a potential breakout? Sequence of higher lows, and if we regard the high of the October 2009 spike as an anomaly, then also higher highs?

Disclosure: I hold.

Disclosure: I am not, nor have I ever been, a pure chartist, so I don't speak the language.

![CropperCapture[1].jpg](https://aussiestockforums.b-cdn.net/data/attachments/31/31633-e5523b533be9b5118d37e729626e6fb1.jpg)