Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,387

- Reactions

- 11,769

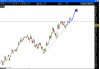

Re: POTENTIAL BREAKOUT Alerts

Looks interesting tech.Just noticed this.

Click to expand

![CropperCapture[2].Png](https://aussiestockforums.b-cdn.net/data/attachments/28/28873-ad6eb331e8bfe2b947a8ea4012024e83.jpg)