You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PLA - Platinum Australia

- Thread starter StockyBailx

- Start date

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

i rode it from .14 to $3 and i have recently added again

they will be mining kalpats long after we have gone to dust

they will be mining kalpats long after we have gone to dust

- Joined

- 9 January 2009

- Posts

- 354

- Reactions

- 0

Looks like the Chinese are going to take up an interest in PLA. Should add some positive sendiments to the SP?

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

Couldn't find the thread among the I-P list

So could a mod please add this

* Soros funds buy shares via Quantum Partners, RS Capital

* Fund managers positive about commodity outlook - analyst

By Julie Crust

LONDON, Oct 12 (Reuters) - Funds controlled by billionaire investor George Soros have acquired at least a 9 percent stake in Platinum Australia Ltd (PLAq.L: Quote, Profile, Research) (PLA.AX: Quote, Profile, Research), the exploration company said in a statement on Monday.

Soros Fund Management acquired about 21.7 million shares via Quantum Partners LDC and RS Capital Partners Ltd on Oct. 8 after a share placement by Platinum Australia.

The move is part of the growing interest shown by fund managers and other investors in the mining sector as commodity prices recover from the lows of 2008.

"We get the feeling that fund managers in general are still very positive about the commodity outlook," said Leon Esterhuizen, analyst at RBC Capital Markets.

"People are starting to look around and see which commodities have been left behind, which particular stocks are left behind, and junior producers generally fall into that category." Platinum Australia operates the Smokey Hills platinum mine in South Africa, which has a projected average annual production capacity of 100,000 ounces of platinum group metals (PGMs), and PGM projects in South Africa and Australia.

Woohoo - About time!!

So could a mod please add this

* Soros funds buy shares via Quantum Partners, RS Capital

* Fund managers positive about commodity outlook - analyst

By Julie Crust

LONDON, Oct 12 (Reuters) - Funds controlled by billionaire investor George Soros have acquired at least a 9 percent stake in Platinum Australia Ltd (PLAq.L: Quote, Profile, Research) (PLA.AX: Quote, Profile, Research), the exploration company said in a statement on Monday.

Soros Fund Management acquired about 21.7 million shares via Quantum Partners LDC and RS Capital Partners Ltd on Oct. 8 after a share placement by Platinum Australia.

The move is part of the growing interest shown by fund managers and other investors in the mining sector as commodity prices recover from the lows of 2008.

"We get the feeling that fund managers in general are still very positive about the commodity outlook," said Leon Esterhuizen, analyst at RBC Capital Markets.

"People are starting to look around and see which commodities have been left behind, which particular stocks are left behind, and junior producers generally fall into that category." Platinum Australia operates the Smokey Hills platinum mine in South Africa, which has a projected average annual production capacity of 100,000 ounces of platinum group metals (PGMs), and PGM projects in South Africa and Australia.

Woohoo - About time!!

Nice spot Gumby.

Platinum Australia share price has been frustrating since the highs in June so hopefully this will provide a catalyst for a boost.

It seems to have formed bit of a triangle in that time, and with Platinum at US$1340 it could be ready to run.

GS/JB Were have a target of $1.35.

Platinum Australia share price has been frustrating since the highs in June so hopefully this will provide a catalyst for a boost.

It seems to have formed bit of a triangle in that time, and with Platinum at US$1340 it could be ready to run.

GS/JB Were have a target of $1.35.

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

Nice spot Gumby.

Platinum Australia share price has been frustrating since the highs in June so hopefully this will provide a catalyst for a boost.

It seems to have formed bit of a triangle in that time, and with Platinum at US$1340 it could be ready to run.

GS/JB Were have a target of $1.35.

Tomorrow should be exciting.

If your not in, it might be quite frustrating!

But yeah waited a while for this momma! She's about to explode!! IMO

- Joined

- 9 January 2009

- Posts

- 354

- Reactions

- 0

I have been waiting for a long time. PLA has been very disappointing despite all the encouraging signs. It's sp has not kept up with the other resources stocks.

I hope George Soros decision will help PLA make up for lost time. The sp should be around $1.60 IMO. Fingers cross for the next few weeks. PLA owes me a few drinks.

I hope George Soros decision will help PLA make up for lost time. The sp should be around $1.60 IMO. Fingers cross for the next few weeks. PLA owes me a few drinks.

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

I have been waiting for a long time. PLA has been very disappointing despite all the encouraging signs. It's sp has not kept up with the other resources stocks.

I hope George Soros decision will help PLA make up for lost time. The sp should be around $1.60 IMO. Fingers cross for the next few weeks. PLA owes me a few drinks.

Don't worry Vinnie. George has auto catalysts in mind for sure. This one looks like a good medium to long term play. Low production costs seem to be the kicker here.

http://www.businessweek.com/investing/green_business/archives/2009/10/george_soros_to.html

George Soros to Invest $1 Billion in Green Energy

Posted by: Mark Scott on October 12

The upcoming climate talks in Copenhagen are less than two months away, and everyone is looking to throw in his/her two cents. On Oct. 10, it was billionaire George Soros’ turn to get in on the act. Giving a speech in Denmark, the man who famously ‘broke the Bank of England’ in the early 1990s now plans to invest $1 billion in clean energy technology. Another $100 million ”” doled out in $10 million increments annually over ten years ”” will fund the newly-created Climate Policy Initiative, a foundation targeted at environmental policy.

That’s a sizeable amount of cash, though Soros didn’t specify where the $1 billion would be spent other than saying ‘stringent conditions’ will be used to evaluate potential investments. And in an ironic twist, Soros, who made a sizeable chunk of his fortune through currency speculation, put his support behind carbon taxes, not cap-and-trade systems. His reason? Financial investors can too easily manipulate carbon markets.

Soros is wise to keep his cards close to his chest. With so much money on the table, potential deals could be given a ‘Soros premium’ if the billionaire focuses on a too-narrow clean energy brief. But some of his likes/dislikes are already known. Soros, for instance, has invested in clean coal technology, including Portsmouth (NH)-based Powerspan Corp that specializes in carbon capture technology.

- Joined

- 9 January 2009

- Posts

- 354

- Reactions

- 0

Don't worry Vinnie. George has auto catalysts in mind for sure. This one looks like a good medium to long term play. Low production costs seem to be the kicker here.

http://www.businessweek.com/investing/green_business/archives/2009/10/george_soros_to.html

George Soros to Invest $1 Billion in Green Energy

Posted by: Mark Scott on October 12

The upcoming climate talks in Copenhagen are less than two months away, and everyone is looking to throw in his/her two cents. On Oct. 10, it was billionaire George Soros’ turn to get in on the act. Giving a speech in Denmark, the man who famously ‘broke the Bank of England’ in the early 1990s now plans to invest $1 billion in clean energy technology. Another $100 million ”” doled out in $10 million increments annually over ten years ”” will fund the newly-created Climate Policy Initiative, a foundation targeted at environmental policy.

That’s a sizeable amount of cash, though Soros didn’t specify where the $1 billion would be spent other than saying ‘stringent conditions’ will be used to evaluate potential investments. And in an ironic twist, Soros, who made a sizeable chunk of his fortune through currency speculation, put his support behind carbon taxes, not cap-and-trade systems. His reason? Financial investors can too easily manipulate carbon markets.

Soros is wise to keep his cards close to his chest. With so much money on the table, potential deals could be given a ‘Soros premium’ if the billionaire focuses on a too-narrow clean energy brief. But some of his likes/dislikes are already known. Soros, for instance, has invested in clean coal technology, including Portsmouth (NH)-based Powerspan Corp that specializes in carbon capture technology.

Gumby.....what would you consider as "clean energy"? I have gas instead of coal powered electricity power plants and electric hybrid cars and wind power electric turbines.

If we try and follow Soro's indications that clean energy is the way to go I would try and target Companies that is developing gas fields. For electric cars and wind farms they will need a lot of rare earth producers to produce the electric motors and batteries.

I guess he bought into PLA because platinum is still way behind it's 2007 peak prices. If my guess is right then perhaps I should also look at nickel.

Any further thoughts??

- Joined

- 3 July 2009

- Posts

- 27,733

- Reactions

- 24,703

At this point in time everyone is going for clean energy. At present the only way forward for vehicles is cleaner emissions wether they be petrol or diesel. Both technologies at this time are using platinum to clean their emissions and with the cash for clunkers in Europe and U.S.A there may be a shortfall in platinum. The recovery process is good but the cars being trashed don't have platinum, therefore one would think there may be a shortfall. WELL THATS MY TWO BOBS WORTH.

- Joined

- 9 January 2009

- Posts

- 354

- Reactions

- 0

Tomorrow should be exciting.

If your not in, it might be quite frustrating!

But yeah waited a while for this momma! She's about to explode!! IMO

After watching the PLA presentation on boardroom radio I don't think PLA is ready to "explode" in the short term. Even at the current prices of around USD1,300 many producers are still losing money. Add to that the price of electricity in Sth Africa is set to double over the next 2 years. Plus all the political instability and black power movement and union strikes it will be a long climb upwards for platinum producers.

It seems the only silver lining amongst the dark clouds is that PLA is a low cost miner. Salvation for this metal is in the medium to long term. Because of the adverse conditions facing the miners most have either reduce production, stop exploration and no new capacity is been added.

Thus, supply is forecasted to either stay stagnant or actually drop. Meanwhile as the world economy recovers demand will pick up and drive prices up. No one is saying when this will happen but it WILL happen. Platinum is out of favour at the moment but it Will recover.

That is why I believe PLA is not a short term proposition, I personally will hold and wait for at least 12 months and see what is going to happen. George Soro's buy in is also very comforting to know. If he can see value in PLA, who am I to argue.

Meanwhile I'll go with the flow and hopefully hit paydirt further down the road. This has not been an easy decision, some of my funds are tied up in PLA and had I sold out and played with Gold and Gas stocks I would have been way in front.

Here is to all PLA holders.....hope when payday comes it will be a big one for all. PLA will be announcing a resource update in the next few weeks (source:- Boardroom Radio). The Kalpat project sounds very promising but it will not bear fruit for a few more years. This is not necessary bad, in fact it sounds like the timing is good. The market should have turned around by then and there isn't many new projects coming into productions in the next few years.

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

After watching the PLA presentation on boardroom radio I don't think PLA is ready to "explode" in the short term. Even at the current prices of around USD1,300 many producers are still losing money. Add to that the price of electricity in Sth Africa is set to double over the next 2 years. Plus all the political instability and black power movement and union strikes it will be a long climb upwards for platinum producers.

It seems the only silver lining amongst the dark clouds is that PLA is a low cost miner. Salvation for this metal is in the medium to long term. Because of the adverse conditions facing the miners most have either reduce production, stop exploration and no new capacity is been added.

Thus, supply is forecasted to either stay stagnant or actually drop. Meanwhile as the world economy recovers demand will pick up and drive prices up. No one is saying when this will happen but it WILL happen. Platinum is out of favour at the moment but it Will recover.

That is why I believe PLA is not a short term proposition, I personally will hold and wait for at least 12 months and see what is going to happen. George Soro's buy in is also very comforting to know. If he can see value in PLA, who am I to argue.

Meanwhile I'll go with the flow and hopefully hit paydirt further down the road. This has not been an easy decision, some of my funds are tied up in PLA and had I sold out and played with Gold and Gas stocks I would have been way in front.

Here is to all PLA holders.....hope when payday comes it will be a big one for all. PLA will be announcing a resource update in the next few weeks (source:- Boardroom Radio). The Kalpat project sounds very promising but it will not bear fruit for a few more years. This is not necessary bad, in fact it sounds like the timing is good. The market should have turned around by then and there isn't many new projects coming into productions in the next few years.

I'm still holding Vinnie.

The power issue in South Africa will be felt through the chain by everyone who needs the metal. IMHO!

Cheers

Gumby

DYOR

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,774

- Reactions

- 10,531

I'm still holding Vinnie.

The power issue in South Africa will be felt through the chain by everyone who needs the metal. IMHO!

Cheers

Gumby

DYOR

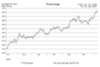

On the chart its in a sweet little trading range.

Technically it is worth watching for a breakout or just trading the range.

gg

Attachments

- Joined

- 9 January 2009

- Posts

- 354

- Reactions

- 0

Platinum is now pushing USD1400!!!! Palladium is pushing USD360. Both metals continue it's recovery from 2008 lows. Supply is not expected to grow because of various problems in South Africa and low demand in 2009.

However, this situation can change very quickly. The demise of the USD will also led to a flight into precious metals. Naturally Gold is the preferred precious metal of choice but platinum is slowly gaining a wider acceptance especially amongst the Chinese.

All is well in the medium to long term. I continue to hold and accumulate in small quantities due to a lack of cash and better short term opportunities elsewhere.

If you can't make money in the last 7 months you will never make money. It will be the next 12 months that will sort the men from the boys. On order to preserve my manhood I am holding PLA because I think it has potential in the next 12 months.

However, this situation can change very quickly. The demise of the USD will also led to a flight into precious metals. Naturally Gold is the preferred precious metal of choice but platinum is slowly gaining a wider acceptance especially amongst the Chinese.

All is well in the medium to long term. I continue to hold and accumulate in small quantities due to a lack of cash and better short term opportunities elsewhere.

If you can't make money in the last 7 months you will never make money. It will be the next 12 months that will sort the men from the boys. On order to preserve my manhood I am holding PLA because I think it has potential in the next 12 months.

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

Platinum is now pushing USD1400!!!!

That's nothing! Just watch for the next little while IMHO

If you're betting on a 12 month recovery of the US Dollar or the discovery of a new producing ready platinum deposit anywhere in the world! Keep betting if there is cash remaining

As always

DYOR

Gumby

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

Great to see PLA as the standout on the ASX200 yesterday. Up 9.81%.

And up again today on volume and a bad day for the index.

Great announcement that Japan Oil, Gas and National Metals Corporations or (JOGMEC) have decided to buy a 35% interest in PLA's Stellex North project.

Nice one!

And up again today on volume and a bad day for the index.

Great announcement that Japan Oil, Gas and National Metals Corporations or (JOGMEC) have decided to buy a 35% interest in PLA's Stellex North project.

Nice one!

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

Porper

Ralph Nelson Elliott

- Joined

- 11 August 2004

- Posts

- 1,413

- Reactions

- 274

Big volume yesterday - second highest volume in the last 12 months! Good signs! Intra day high of $1.29.

It was massive volume but look where the close was. Right on the low of the bar. There were plenty of sellers yesterday. The first warning sign of a reversal. I think some consolidation is in order at least.Worst case we reverse immediately.

I hold. Stop now at $1.15.