tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,478

Hey GG....I feel you are jumping to the defence of tech/a.....he can stand on his own 2 feet.

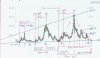

Seems folk knock W D Gann.....I had already seen repetition in PEN.....Is reassuring to know lengendary traders as W D Gann prove repetition in stocks is cyclic............Rock on sub 2 cents

Larry Williams (When in Australia) Challeneged David Bowden (Safety in the Market) To out trade him using Gann.

The bet was 1 million.

Bowden wisely declined.

Here is some lite reading.

https://www.aussiestockforums.com/forums/archive/index.php/t-13871.html

Is reassuring to know legendary traders as W D Gann prove repetition in stocks is cyclic

I love Gann experts.

They are Drivel professionals.

Could you just put up the evidence of proof for/of Cyclic repetition in stocks.

No hurry when you dig it up. Oh hind site just wont do.

Perhaps 10 charts with 10 Cyclic Pressure points which are coming up.

We will see how many are hit. Ill even give you a few days before and after the "Date"

In fact Ill give you $100 for everyone you get right (Well Ill donate it to Joe and ASF).

I'm sure you'll do the same for everyone wrong--after all it is about being right---RIGHT?

Should be fun and highly profitable for Joe.

The path to profit will reveal itself when your good and ready.

Long time off by the look of things.

Good luck.