- Joined

- 18 May 2012

- Posts

- 303

- Reactions

- 0

Kenya extends Australia firm licence for explore oil

May 18,2014

NAIROBI, May 17 (Xinhua) -- The Kenyan government has granted a year extension to an Australian oil and gas firm Pancontinental to plan future explorations in the East African nation.

Pancontinental said in a statement released on Saturday that it intends to use the extended period to secure a farm-in agreement for any future L10B drilling.

The Australian firm is the longest standing oil and gas explorer offshore Kenya and participated in originating the L6and the L8 projects.

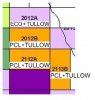

According to Pancontinental, L10B has a number of large prospects and leads identified using 3D seismic and these are being examined as potential exploration drilling targets.

"Pancontinental also advises that it has notified BG Group, the London-listed FTSE-100 company which operates the licence, and the other joint venture participants, that it will increase its stake in L10B from 15 percent to 20 percent," the statement said.

Pancontinental said it will increase its stake prior to June 15, subject to the government's approval.

In L10A and L10B, the Joint Venture led by BG Group is interpreting 3D data in anticipation of identifying a number of prospects for drilling.

It said the extension of the exploration period by Kenya will give the joint venture partners more time to assess the impact of the Sunbird-1 discovery in the adjacent L10A area (PCL 18.75 percent) and its implications for possible future drilling in L10B.

Pancontinental has increased its stake in L10B by taking up its pro-rata share of the interest held by Premier Oil, which has decided to withdraw.

The changes in interests are subject to the approval of Kenya's ministry of energy and such approval is not expected to be withheld.

In April, the exploration company announced that oil, as well as gas, had been discovered in Sunbird-1 offshore Kenya.

The characteristics of the oil and gas discovery continue to be analyzed and will be announced when a complete and integrated analysis has been made available to the joint venture by the operator.

"The characteristics of the oil and gas discovery continue to be analyzed and will be announced when a complete and integrated analysis has been made available to the joint venture by the operator," it said.

Pancontinental believes that the significant prospectively of L10B and the opportunity to increase its interest with other partners in L10B at no cost, as well as the prospectively of adjacent area L10A, means it is well-placed to farm-out a portion of its interest in both licences on attractive terms and in a suitable time-frame under the 12-month extension.

The East African margin has become a focus of the global oil and gas exploration and production industry.

South of Kenya, offshore Tanzania and Mozambique, several major gas discoveries have been made by Anadarko Corporation, ENI, Statoil and BG.

The East African nation has a huge mineral potential but its exploration efforts have only picked in the last five years with the awarding of commercial licences in prospecting for oil, gold, coal, geothermal and rare earths.

http://www.shanghaidaily.com/article/article_xinhua.aspx?id=218998

May 18,2014

NAIROBI, May 17 (Xinhua) -- The Kenyan government has granted a year extension to an Australian oil and gas firm Pancontinental to plan future explorations in the East African nation.

Pancontinental said in a statement released on Saturday that it intends to use the extended period to secure a farm-in agreement for any future L10B drilling.

The Australian firm is the longest standing oil and gas explorer offshore Kenya and participated in originating the L6and the L8 projects.

According to Pancontinental, L10B has a number of large prospects and leads identified using 3D seismic and these are being examined as potential exploration drilling targets.

"Pancontinental also advises that it has notified BG Group, the London-listed FTSE-100 company which operates the licence, and the other joint venture participants, that it will increase its stake in L10B from 15 percent to 20 percent," the statement said.

Pancontinental said it will increase its stake prior to June 15, subject to the government's approval.

In L10A and L10B, the Joint Venture led by BG Group is interpreting 3D data in anticipation of identifying a number of prospects for drilling.

It said the extension of the exploration period by Kenya will give the joint venture partners more time to assess the impact of the Sunbird-1 discovery in the adjacent L10A area (PCL 18.75 percent) and its implications for possible future drilling in L10B.

Pancontinental has increased its stake in L10B by taking up its pro-rata share of the interest held by Premier Oil, which has decided to withdraw.

The changes in interests are subject to the approval of Kenya's ministry of energy and such approval is not expected to be withheld.

In April, the exploration company announced that oil, as well as gas, had been discovered in Sunbird-1 offshore Kenya.

The characteristics of the oil and gas discovery continue to be analyzed and will be announced when a complete and integrated analysis has been made available to the joint venture by the operator.

"The characteristics of the oil and gas discovery continue to be analyzed and will be announced when a complete and integrated analysis has been made available to the joint venture by the operator," it said.

Pancontinental believes that the significant prospectively of L10B and the opportunity to increase its interest with other partners in L10B at no cost, as well as the prospectively of adjacent area L10A, means it is well-placed to farm-out a portion of its interest in both licences on attractive terms and in a suitable time-frame under the 12-month extension.

The East African margin has become a focus of the global oil and gas exploration and production industry.

South of Kenya, offshore Tanzania and Mozambique, several major gas discoveries have been made by Anadarko Corporation, ENI, Statoil and BG.

The East African nation has a huge mineral potential but its exploration efforts have only picked in the last five years with the awarding of commercial licences in prospecting for oil, gold, coal, geothermal and rare earths.

http://www.shanghaidaily.com/article/article_xinhua.aspx?id=218998