bigdog

Retired many years ago

- Joined

- 19 July 2006

- Posts

- 8,202

- Reactions

- 5,635

Stock market today: Wall Street closes out its 7th straight winning week with a quiet finish

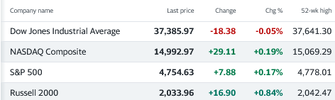

Wall Street drifted through mixed trading to put a quiet end to another rocking week. The S&P 500 finished nearly unchanged Friday, down less than 0.1%.

Wall Street closes out its 7th straight winning week with a quiet finish

By STAN CHOEWall Street drifted through mixed trading on Friday to put a quiet end to another rocking week.

The S&P 500 finished nearly unchanged for the day, down 0.36, or less than 0.1%, at 4,719.19. But it’s still hanging within 1.6% of its all-time high set early last year, and it closed out a seventh straight winning week for its longest such streak in six years.

The Dow Jones Industrial Average, which tracks a smaller slice of the U.S. stock market, rose 56.81 points, or 0.2%, to 37,305.16 and set a record for the third straight day. The Nasdaq composite climbed 52.36, or 0.4%, to 14,813.92.

Costco helped lead the market with a 4.4% gain. It reported stronger results for the latest quarter than analysts expected and said it will send $6.7 billion in cash to its shareholders through a special $15 dividend. That helped offset a 3.6% slump for Lennar. The homebuilder reported stronger profit for the latest quarter, but it also gave a forecast for a measure of profitability in the current quarter that fell shy of analysts’ expectations.

Stocks overall bolted higher this week after the Federal Reserve seemed to give a nod toward the hopes that have sent Wall Street screaming higher since Halloween. Fed Chair Jerome Powell at a press conference on Wednesday did not forcefully push back on traders’ expectations that inflation has cooled enough for the central bank to shift to cutting interest rates after yanking them dramatically higher since early last year.

The S&P 500 has jumped roughly 15% since late October on rising hopes for just such a pivot. Lower rates not only give a boost to prices for all kinds of investments, they also relax the pressure on the economy and the financial system.

Hopes for several cuts to rates from the Fed in 2024 have sent Treasury yields tumbling in the bond market, which in turn releases pressure on the stock market.

The 10-year yield eased further on Friday. It slipped to 3.91% from 3.92% late Thursday. It had been above 5% in October and at its highest since 2007.

With inflation down from its peak, Bank of America is forecasting 152 rate cuts from central banks around the world in 2024. That would be the first year since 2020 that cuts have outpaced hikes.

Of course, some more cautious investors say markets have gotten ahead of themselves in their ebullience. The big moves seem to be predicated on the Federal Reserve pulling off what was considered a nearly impossible task not long ago.

The Fed’s goal has been to slow the economy and grind down prices for investments enough through high interest rates to get inflation under control. It then has to loosen the brakes at the exact right time. If it waits too long, the economy could fall into a painful recession. If it moves too early, inflation could reaccelerate and add misery for everyone.

That’s a lot of ifs. Plus, many critics say the number of rate cuts that traders are expecting in 2024 doesn’t seem likely unless the U.S. economy falls into a recession.

With the huge rallies so far, “markets all-in on infallible Fed,” strategist Michael Hartnett wrote in a BofA Global Research report.

Those rallies may also be threatening the futures investors are banking on. Lower Treasury yields and higher stock prices can encourage businesses and households to spend more, which keeps the economy strong but can add upward pressure on inflation.

A preliminary report on Friday indicated growth for U.S. business activity may be ticking higher. It cited “looser financial conditions,” which is another way of describing market movements that could encourage businesses and people to spend more.

“Looser financial conditions have helped boost demand, business activity and employment in the service sector, and have also helped lift future output expectations higher,” said Chris Williamson, chief business economist at S&P Global Market Intelligence.

Williamson also said a measure of pressure on inflation “remains sticky but at a level which is indicative of” inflation at the consumer level running only modestly above 2%. The Fed’s goal is to keep inflation at roughly 2% while maximizing the job market.

In stock markets abroad, Hong Kong’s Hang Seng index jumped 2.4%, with stocks of property developers rising after some Chinese cities eased buying restrictions. The Hong Kong market has been one of the world’s worst this year on worries about property developers and the overall health of the Chinese economy.

Most other markets around the world have been strong in 2023 amid hopes for cooling inflation and anticipation for cuts to interest rates.