bigdog

Retired many years ago

- Joined

- 19 July 2006

- Posts

- 8,203

- Reactions

- 5,637

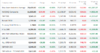

Stocks rally worldwide on Election Day; S&P 500 climbs 1.8%

Stocks powered higher Tuesday as investors hope the end of a bruising U.S. presidential campaign may soon lift the heavy uncertainty that’s sent markets spinning recently.

The S&P 500 rose 58.92 points, or 1.8%, to 3,369.16 for its second straight healthy gain. The rally was widespread and global, with Treasury yields, oil prices and stocks around the world all strengthening.

The Dow Jones Industrial Average climbed 554.98, or 2.1%, to 27,480.03, and the Nasdaq composite added 202.96, or 1.9%, to 11,160.57.

More than anything, what investors hope for from the election is a clear winner to emerge, even if it takes some time for all the votes to be tallied. Whether that’s President Donald Trump or former Vice President Joe Biden is less important, because history shows stocks tend to rise regardless of which party controls the White House.

“The markets are neither red nor blue, and today they’re decidedly green,” said Rod von Lipsey, managing director at UBS Private Wealth Management.

What investors fear is the prospect of a contested election, one that drags on and injects even more uncertainty into markets. Under such a scenario, much of Wall Street expects a sharp drop in stocks. The future political makeup of the Senate is another unknown throwing uncertainty into the markets, along with the timing of a possible COVID-19 vaccine.

“There’s a sense that we might get some clarity on the outcome of the direction of one or two wild cards that have been moving the market,” von Lipsey said.

If Biden ends up winning, as polls suggest, the thought is that could open the door to a big support package for the economy, particularly if the Democrats also take control of the Senate. Some areas of the market that would benefit from a large stimulus effort and spending on infrastructure rose more than the rest of the market Tuesday, including stocks of smaller companies and industrial businesses.

If Trump were to win and the Senate stays under Republican control, it would likely lead to less stimulus than under a Democratic sweep, according to Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. A Biden win and Republican Senate would be least beneficial to stocks, meanwhile, because it would mean the lowest chance for stimulus.

Investors and economists have been clamoring for a renewal of stimulus since the expiration of the last round of supplemental benefits for laid-off workers and other support approved earlier by Congress.

But investors see cases for optimism in other electoral scenarios, too. If Trump were to win, that would likely mean a continuation of lower tax rates and lighter regulation on businesses, which would prop up the corporate profits that are the lifeblood of the stock market.

Ultimately, many professional investors say which party controls Washington matters much less to the economy and markets than what happens with the pandemic and whether a vaccine can arrive soon to help the economy heal.

The last two days of gains for Wall Street have helped the S&P 500 recover roughly half its 5.6% loss from last week, which was its worst since the market was plunging in March.

While the election is dominating investors’ attention, plenty of other market-moving events are looming this week. The Federal Reserve is meeting on interest-rate policy and will announce its decision on Thursday. Its earlier moves to slash interest rates to record lows and to step forcefully into bond markets to push prices higher have helped Wall Street soar since March.

ASX 200 flat ahead of US election result.

It looks set to be a potentially volatile day of trade for the Australian share market due to the U.S. election. The result of which should start to filter through during our trading day. For now, according to the latest SPI futures, the ASX 200 is expected to open the day flat. The Dow Jones Industrial Average climbed 554.98, or 2.1%, to 27,480.03, and the Nasdaq composite added 202.96, or 1.9%, to 11,160.57.

https://apnews.com/article/stocks-rally-worldwide-election-day-2cc8445c88a7d2c9135507a8722bcf9e

Stocks rally worldwide on Election Day; S&P 500 climbs 1.8%

By STAN CHOE and DAMIAN J. TROISE 18 minutes ago

NEW YORK (AP) — Stocks powered higher Tuesday as investors hope the end of a bruising U.S. presidential campaign may soon lift the heavy uncertainty that’s sent markets spinning recently.

The S&P 500 rose 58.92 points, or 1.8%, to 3,369.16 for its second straight healthy gain. The rally was widespread and global, with Treasury yields, oil prices and stocks around the world all strengthening.

The Dow Jones Industrial Average climbed 554.98, or 2.1%, to 27,480.03, and the Nasdaq composite added 202.96, or 1.9%, to 11,160.57.

More than anything, what investors hope for from the election is a clear winner to emerge, even if it takes some time for all the votes to be tallied. Whether that’s President Donald Trump or former Vice President Joe Biden is less important, because history shows stocks tend to rise regardless of which party controls the White House.

“The markets are neither red nor blue, and today they’re decidedly green,” said Rod von Lipsey, managing director at UBS Private Wealth Management.

What investors fear is the prospect of a contested election, one that drags on and injects even more uncertainty into markets. Under such a scenario, much of Wall Street expects a sharp drop in stocks. The future political makeup of the Senate is another unknown throwing uncertainty into the markets, along with the timing of a possible COVID-19 vaccine.

“There’s a sense that we might get some clarity on the outcome of the direction of one or two wild cards that have been moving the market,” von Lipsey said.

If Biden ends up winning, as polls suggest, the thought is that could open the door to a big support package for the economy, particularly if the Democrats also take control of the Senate. Some areas of the market that would benefit from a large stimulus effort and spending on infrastructure rose more than the rest of the market Tuesday, including stocks of smaller companies and industrial businesses.

If Trump were to win and the Senate stays under Republican control, it would likely lead to less stimulus than under a Democratic sweep, according to Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. A Biden win and Republican Senate would be least beneficial to stocks, meanwhile, because it would mean the lowest chance for stimulus.

Investors and economists have been clamoring for a renewal of stimulus since the expiration of the last round of supplemental benefits for laid-off workers and other support approved earlier by Congress.

But investors see cases for optimism in other electoral scenarios, too. If Trump were to win, that would likely mean a continuation of lower tax rates and lighter regulation on businesses, which would prop up the corporate profits that are the lifeblood of the stock market.

Ultimately, many professional investors say which party controls Washington matters much less to the economy and markets than what happens with the pandemic and whether a vaccine can arrive soon to help the economy heal.

The last two days of gains for Wall Street have helped the S&P 500 recover roughly half its 5.6% loss from last week, which was its worst since the market was plunging in March.

While the election is dominating investors’ attention, plenty of other market-moving events are looming this week. The Federal Reserve is meeting on interest-rate policy and will announce its decision on Thursday. Its earlier moves to slash interest rates to record lows and to step forcefully into bond markets to push prices higher have helped Wall Street soar since March.

The Labor Department is also releasing its jobs report for October on Friday, where economists expect to see another slowdown in growth. Meanwhile, it’s another heavy week for corporate earnings reports as companies continue to report drops in profit for the summer that weren’t as bad as Wall Street feared.

Hanging above it all is the continuing coronavirus pandemic. Several European governments are bringing back restrictions on businesses in hopes of stemming worsening virus counts. In the United States, where infections are also rising at a troubling rate, the worry is that fear alone of the virus could depress sales for companies.

So far this earnings reporting season, companies are saying their profits fell during the summer, but not by as much as Wall Street feared.

Arista Networks jumped 15.4% for the biggest gain in the S&P 500 after the cloud-networking company reported a 19% drop in net income that nevertheless topped analysts’ forecasts.

Stock indexes across Europe and Asia rose 2% or more, while the yield on the 10-year Treasury climbed to 0.88% from 0.84% late Monday.

A gauge of fear in the U.S. stock market, which measures expected volatility for the S&P 500, fell 6.4% and continued its decline following last week’s jump to its highest level since June.

Stocks powered higher Tuesday as investors hope the end of a bruising U.S. presidential campaign may soon lift the heavy uncertainty that’s sent markets spinning recently.

The S&P 500 rose 58.92 points, or 1.8%, to 3,369.16 for its second straight healthy gain. The rally was widespread and global, with Treasury yields, oil prices and stocks around the world all strengthening.

The Dow Jones Industrial Average climbed 554.98, or 2.1%, to 27,480.03, and the Nasdaq composite added 202.96, or 1.9%, to 11,160.57.

More than anything, what investors hope for from the election is a clear winner to emerge, even if it takes some time for all the votes to be tallied. Whether that’s President Donald Trump or former Vice President Joe Biden is less important, because history shows stocks tend to rise regardless of which party controls the White House.

“The markets are neither red nor blue, and today they’re decidedly green,” said Rod von Lipsey, managing director at UBS Private Wealth Management.

What investors fear is the prospect of a contested election, one that drags on and injects even more uncertainty into markets. Under such a scenario, much of Wall Street expects a sharp drop in stocks. The future political makeup of the Senate is another unknown throwing uncertainty into the markets, along with the timing of a possible COVID-19 vaccine.

“There’s a sense that we might get some clarity on the outcome of the direction of one or two wild cards that have been moving the market,” von Lipsey said.

If Biden ends up winning, as polls suggest, the thought is that could open the door to a big support package for the economy, particularly if the Democrats also take control of the Senate. Some areas of the market that would benefit from a large stimulus effort and spending on infrastructure rose more than the rest of the market Tuesday, including stocks of smaller companies and industrial businesses.

If Trump were to win and the Senate stays under Republican control, it would likely lead to less stimulus than under a Democratic sweep, according to Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. A Biden win and Republican Senate would be least beneficial to stocks, meanwhile, because it would mean the lowest chance for stimulus.

Investors and economists have been clamoring for a renewal of stimulus since the expiration of the last round of supplemental benefits for laid-off workers and other support approved earlier by Congress.

But investors see cases for optimism in other electoral scenarios, too. If Trump were to win, that would likely mean a continuation of lower tax rates and lighter regulation on businesses, which would prop up the corporate profits that are the lifeblood of the stock market.

Ultimately, many professional investors say which party controls Washington matters much less to the economy and markets than what happens with the pandemic and whether a vaccine can arrive soon to help the economy heal.

The last two days of gains for Wall Street have helped the S&P 500 recover roughly half its 5.6% loss from last week, which was its worst since the market was plunging in March.

While the election is dominating investors’ attention, plenty of other market-moving events are looming this week. The Federal Reserve is meeting on interest-rate policy and will announce its decision on Thursday. Its earlier moves to slash interest rates to record lows and to step forcefully into bond markets to push prices higher have helped Wall Street soar since March.

ASX 200 flat ahead of US election result.

It looks set to be a potentially volatile day of trade for the Australian share market due to the U.S. election. The result of which should start to filter through during our trading day. For now, according to the latest SPI futures, the ASX 200 is expected to open the day flat. The Dow Jones Industrial Average climbed 554.98, or 2.1%, to 27,480.03, and the Nasdaq composite added 202.96, or 1.9%, to 11,160.57.

https://apnews.com/article/stocks-rally-worldwide-election-day-2cc8445c88a7d2c9135507a8722bcf9e

Stocks rally worldwide on Election Day; S&P 500 climbs 1.8%

By STAN CHOE and DAMIAN J. TROISE 18 minutes ago

NEW YORK (AP) — Stocks powered higher Tuesday as investors hope the end of a bruising U.S. presidential campaign may soon lift the heavy uncertainty that’s sent markets spinning recently.

The S&P 500 rose 58.92 points, or 1.8%, to 3,369.16 for its second straight healthy gain. The rally was widespread and global, with Treasury yields, oil prices and stocks around the world all strengthening.

The Dow Jones Industrial Average climbed 554.98, or 2.1%, to 27,480.03, and the Nasdaq composite added 202.96, or 1.9%, to 11,160.57.

More than anything, what investors hope for from the election is a clear winner to emerge, even if it takes some time for all the votes to be tallied. Whether that’s President Donald Trump or former Vice President Joe Biden is less important, because history shows stocks tend to rise regardless of which party controls the White House.

“The markets are neither red nor blue, and today they’re decidedly green,” said Rod von Lipsey, managing director at UBS Private Wealth Management.

What investors fear is the prospect of a contested election, one that drags on and injects even more uncertainty into markets. Under such a scenario, much of Wall Street expects a sharp drop in stocks. The future political makeup of the Senate is another unknown throwing uncertainty into the markets, along with the timing of a possible COVID-19 vaccine.

“There’s a sense that we might get some clarity on the outcome of the direction of one or two wild cards that have been moving the market,” von Lipsey said.

If Biden ends up winning, as polls suggest, the thought is that could open the door to a big support package for the economy, particularly if the Democrats also take control of the Senate. Some areas of the market that would benefit from a large stimulus effort and spending on infrastructure rose more than the rest of the market Tuesday, including stocks of smaller companies and industrial businesses.

If Trump were to win and the Senate stays under Republican control, it would likely lead to less stimulus than under a Democratic sweep, according to Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. A Biden win and Republican Senate would be least beneficial to stocks, meanwhile, because it would mean the lowest chance for stimulus.

Investors and economists have been clamoring for a renewal of stimulus since the expiration of the last round of supplemental benefits for laid-off workers and other support approved earlier by Congress.

But investors see cases for optimism in other electoral scenarios, too. If Trump were to win, that would likely mean a continuation of lower tax rates and lighter regulation on businesses, which would prop up the corporate profits that are the lifeblood of the stock market.

Ultimately, many professional investors say which party controls Washington matters much less to the economy and markets than what happens with the pandemic and whether a vaccine can arrive soon to help the economy heal.

The last two days of gains for Wall Street have helped the S&P 500 recover roughly half its 5.6% loss from last week, which was its worst since the market was plunging in March.

While the election is dominating investors’ attention, plenty of other market-moving events are looming this week. The Federal Reserve is meeting on interest-rate policy and will announce its decision on Thursday. Its earlier moves to slash interest rates to record lows and to step forcefully into bond markets to push prices higher have helped Wall Street soar since March.

The Labor Department is also releasing its jobs report for October on Friday, where economists expect to see another slowdown in growth. Meanwhile, it’s another heavy week for corporate earnings reports as companies continue to report drops in profit for the summer that weren’t as bad as Wall Street feared.

Hanging above it all is the continuing coronavirus pandemic. Several European governments are bringing back restrictions on businesses in hopes of stemming worsening virus counts. In the United States, where infections are also rising at a troubling rate, the worry is that fear alone of the virus could depress sales for companies.

So far this earnings reporting season, companies are saying their profits fell during the summer, but not by as much as Wall Street feared.

Arista Networks jumped 15.4% for the biggest gain in the S&P 500 after the cloud-networking company reported a 19% drop in net income that nevertheless topped analysts’ forecasts.

Stock indexes across Europe and Asia rose 2% or more, while the yield on the 10-year Treasury climbed to 0.88% from 0.84% late Monday.

A gauge of fear in the U.S. stock market, which measures expected volatility for the S&P 500, fell 6.4% and continued its decline following last week’s jump to its highest level since June.