bigdog

Retired many years ago

- Joined

- 19 July 2006

- Posts

- 8,203

- Reactions

- 5,637

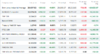

ASX futures pointing lower.

The ASX 200’s winning streak looks set to be tested on Monday despite a positive finish to the week on Wall Street. According to the latest SPI futures, the benchmark index is expected to fall 5 points at the open on Monday. On Friday night the Dow Jones rose 0.6%, the S&P 500 climbed 0.9%, and the Nasdaq index stormed 1.4% higher. The latter could be good news for tech shares such as Afterpay Ltd (ASX: APT) and Xero Limited (ASX: XRO).

The ASX 200’s winning streak looks set to be tested on Monday despite a positive finish to the week on Wall Street. According to the latest SPI futures, the benchmark index is expected to fall 5 points at the open on Monday. On Friday night the Dow Jones rose 0.6%, the S&P 500 climbed 0.9%, and the Nasdaq index stormed 1.4% higher. The latter could be good news for tech shares such as Afterpay Ltd (ASX: APT) and Xero Limited (ASX: XRO).