You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

NWS - News Corporation

- Thread starter markrmau

- Start date

Re: NWS - newscorp

There is one fundamental weakness with this company, IMO.

The CEO is not getting any younger.

Management succession is a huge issue.

Also, media has been riding the long bull run. Economic conditions going forward, will not be as accommodating, by my reckoning.

Financial analysis of this company is probably harder than most people admit to.

I do not and will not hold.

There is one fundamental weakness with this company, IMO.

The CEO is not getting any younger.

Management succession is a huge issue.

Also, media has been riding the long bull run. Economic conditions going forward, will not be as accommodating, by my reckoning.

Financial analysis of this company is probably harder than most people admit to.

I do not and will not hold.

- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

Re: NWS - newscorp

Its good to see talk about an American Equity....

Here is my view of the situation .....

I dont want to see anyone get hurt out there ....

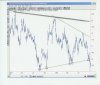

Looking a little bit longer term ... These charts look bearish ...

Is anyone familiar with Symetrical Triangles ?

Well, this is a massive one .....

STARTING TO LOOK LIKE A BREAK OUT... ( LONG TERM ) .....

ONLY AN OBSERVATION ......

--------------------------------------------------------------------------

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

Its good to see talk about an American Equity....

Here is my view of the situation .....

I dont want to see anyone get hurt out there ....

Looking a little bit longer term ... These charts look bearish ...

Is anyone familiar with Symetrical Triangles ?

Well, this is a massive one .....

STARTING TO LOOK LIKE A BREAK OUT... ( LONG TERM ) .....

ONLY AN OBSERVATION ......

--------------------------------------------------------------------------

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

Attachments

Re: NWS - newscorp

bearish ?? cant see it. TL supp low risk entry imo

get hurt ?? dont worry about me, stop losses prevent major equity meltdown.

as far as charting NWS over such a time frame i would be looking at ASX NWS charts as for most of your time period was predominanatly ASX traded stock as such with ASX leading US ADR price . lot of the major swings in SP were influenced to a degree by FX alterations rather than US sentiment

US indice included only recently so effectively only US price action led in recent history

appreciate comments and diversified view

....................... Pete

will post asx NWS chart shortly

if you overlay SPX chart you will see NWS.N basically follows SPX variations so in effect you seem to be bearish on US indice ????

MARKETWAVES said:Its good to see talk about an American Equity....

Here is my view of the situation .....

I dont want to see anyone get hurt out there ....

Looking a little bit longer term ... These charts look bearish ...

Is anyone familiar with Symetrical Triangles ?

Well, this is a massive one .....

STARTING TO LOOK LIKE A BREAK OUT... ( LONG TERM ) .....

ONLY AN OBSERVATION ......

--------------------------------------------------------------------------

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

bearish ?? cant see it. TL supp low risk entry imo

get hurt ?? dont worry about me, stop losses prevent major equity meltdown.

as far as charting NWS over such a time frame i would be looking at ASX NWS charts as for most of your time period was predominanatly ASX traded stock as such with ASX leading US ADR price . lot of the major swings in SP were influenced to a degree by FX alterations rather than US sentiment

US indice included only recently so effectively only US price action led in recent history

appreciate comments and diversified view

....................... Pete

will post asx NWS chart shortly

if you overlay SPX chart you will see NWS.N basically follows SPX variations so in effect you seem to be bearish on US indice ????

- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

Re: NWS - Newscorp

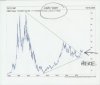

This is what I was trying to explain pete .....

The larger time frame always more important than the smaller time frame ..... the last charts to look at should always be daily or intraday charts ...

I am telling all this to people and traders in all my travels....

---------------------------------------------------------------------

This stock broke support and it broke it hard......

hope you were saved by your protective stop... it's good to talk to a trader that understands the importance of using them....

Moving on ....

I would like to POINT OUT a Stock that is doing the exact opposite of NWS technically speaking that is ... It also is making a symetrical triangle .... but is breaking to the upside ... the Stock by the way is AMZN....

Take a look down below ...

----------------------------------------------------------------------

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

This is what I was trying to explain pete .....

The larger time frame always more important than the smaller time frame ..... the last charts to look at should always be daily or intraday charts ...

I am telling all this to people and traders in all my travels....

---------------------------------------------------------------------

This stock broke support and it broke it hard......

hope you were saved by your protective stop... it's good to talk to a trader that understands the importance of using them....

Moving on ....

I would like to POINT OUT a Stock that is doing the exact opposite of NWS technically speaking that is ... It also is making a symetrical triangle .... but is breaking to the upside ... the Stock by the way is AMZN....

Take a look down below ...

----------------------------------------------------------------------

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

Attachments

RichKid

PlanYourTrade > TradeYourPlan

- Joined

- 18 June 2004

- Posts

- 3,031

- Reactions

- 5

Newscorp may be back on the XJO index so more fund managers would have to buy in: http://www.theaustralian.news.com.au/story/0,20867,19194280-643,00.html

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,578

- Reactions

- 12,704

Shoot, Rich!

It's actually showing some nice swing tradeable waves. It's obvious I have ignored it for too long.

Could my nemesis make it back onto my watchlist?

...my heart is beating real fast at the thought

It's actually showing some nice swing tradeable waves. It's obvious I have ignored it for too long.

Could my nemesis make it back onto my watchlist?

...my heart is beating real fast at the thought

There use to be a way of finding the listing price of a stock but I can't remember how if my life depended on it. I am trying to find the original issue price for news, not the one a few years back when it merged or whatever.

Any help would be apreciated

thanx

Any help would be apreciated

thanx

- Joined

- 13 February 2006

- Posts

- 4,994

- Reactions

- 11,213

Current Price $19.25

Code NWS-A

Yield 0.6%

Market Capitalization $77289.0

TCI Price Target $0.00

Investment Sector Entertainment Diversified

Price/Earnings Ratio 28.9

Recommendation Avoid

INDUSTRY STATISTICS

Market Capitalization: 243B

Price / Earnings: 18.0

Price / Book: -36.2

Net Profit Margin 10.3%

Price To Free Cash Flow 121.5

Return on Equity: 9.0%

Total Debt / Equity: 0.4

Dividend Yield: 1.3%

The Industry is not for the faint of heart. Earnings and profitability are fleeting. The return on equity is low, and does not adequately compensate above the returns available on debt. The business is capital intensive, with low returns on capital and with very low profit margins.

If, the securities were cheap, on a bargain basis, then possibly a candidate may be located. Currently this is not the case with the average P/E ratio at 18.

CAPITALIZATION

Market Cap 60.72B

Enterprise Value 66.60B

Trailing P/E 28.90

Forward P/E 18.69

PEG Ratio (5 yr expected): 1.11

Price/Sales 2.45

Price/Book 2.13

Enterprise Value/Revenue 2.70

Enterprise Value/EBITDA 12.064

Capitalization structure is a very important component within the story of NWS-A & NWS.

The above figures representing Enterprise value are inaccurate. They are inaccurate for the reason that they do not take into account the “Off Balance Sheet” Operating Leases. These Operating Leases add some $5859.0 million to the effective debt. This is “potentially” a severe problem. The earnings are extremely volatile, and fluctuate wildly. Without a consistent margin above Interest on debt + Operating Leases, bankruptcy proceedings could be initiated by the “minority” bondholders.

How possible or likely is this?

It has happened once in the last five years, and been close on one other occasion.

Did the bondholders trigger bankruptcy? No, but they technically could have.

The second far more serious problem with the Capitalization resides within the Common stock itself.

There are two classes of Common stock; Class A and Class B.

Class A common stock represents the original common stock.

Class B common stock represents the converted Preferred Stock. This was converted on a 1 for 2 basis and was designed as a “Poison Pill” defense against NWS being acquired. Only Class B has voting rights, and thus control resides in one class of common stock that is held by Mr. Murdoch.

Therefore NWS is only going to be controlled by this one “unaccountable” owner. There will be no method by which the control of the company and its policies can be influenced by the other owners.

Holding NWS is therefore an examination of management and the strategies of management.

Have they been profitable and in the minority owners best interests?

INCOME STATEMENT

Profit Margin 8.84%

Operating Margin 15.59%

Return on Assets 5.25%

Return on Equity 9.65%

From the two margins we can ascertain that this business is just not that profitable. The Profit margin and Return on Equity are the two margins that flow to the Class-A common stock. They are poor. On aggregate the Profit Margin is 3.3%. This is not a profitable business.

Return on assets seemingly is high. This is very misleading.

The Return on Assets returns some $4.60 on investment. If we look at a different industry to get some perspective of what is possible, looking at OFIX the Return on Assets is $16.48. OFIX is also an “acquirer” of assets. The message being that you can buy high return assets that directly flow to the bottom line or you can buy low return assets. NWS tends to buy very low return assets.

The reason for such low profitability lies in the very high Costs associated with the business. Some 82% of gross revenues are consumed within the costs. Are there any discretionary cash-flows within the cost structure that are hidden, providing the margin of safety of redirecting them in time of need? Not at all, the Costs contain nothing that can be salvaged. This suggests poor negotiating on contracts with providers of content, be that the various sports bodies [NFL, NHL, etc]

The only discretionary cash-flows identified were found within Capital Expenditures. These amounted to $55.4 million or $0.01 per share.

BALANCE SHEET

Total Cash 5.32B

Total Cash Per Share 1.688

Total Debt 11.43B

Total Debt/Equity 0.401

Current Ratio 1.866

Book Value Per Share 9.021

Immediately there are problems that are highly visible that must call into question the advisability of NWS as an investment grade common stock.

The Current ratio falls below the minimum 2.0 required.

The debt is understated by the amount contracted to the Operating Leases.

The return on Retained Earnings has been 0.00%

This is unacceptable as an investment. It demonstrates unequivocally that the investment decisions under the incumbent management have destroyed shareholder value. The common stock is a pure speculation.

The Book Value resides in liquidation value only, and as such should be discounted by an appropriate rate as the demonstrated returns fall far below the purchase price paid. It is this either gross underperformance of purchased assets, or, poorly selected assets, combined with the poison pill defense that makes NWS such a dangerous investment.

SUMMARY

What do the Institutions think of NWS?

Well currently not that much.

Only some 10% of the float is owned by the Mutual Funds & Hedge Funds. This for such a large capitalization common stock is a very insignificant holding. I suspect the dual class of common stock is a negative in this age of owner activism. There is no way that value can be unlocked or increased without the management’s compliance.

The calculated Intrinsic Value = $0.00

Liquidation Value is the relevant valuation here, but has not been calculated.

The intricate capitalization structure designed to retain control of the business and thus the allocation of capital could be of benefit with the right management. With the incumbent management and demonstrated returns, it is an unmitigated disaster. I would advise looking elsewhere for an investment.

Code NWS-A

Yield 0.6%

Market Capitalization $77289.0

TCI Price Target $0.00

Investment Sector Entertainment Diversified

Price/Earnings Ratio 28.9

Recommendation Avoid

INDUSTRY STATISTICS

Market Capitalization: 243B

Price / Earnings: 18.0

Price / Book: -36.2

Net Profit Margin 10.3%

Price To Free Cash Flow 121.5

Return on Equity: 9.0%

Total Debt / Equity: 0.4

Dividend Yield: 1.3%

The Industry is not for the faint of heart. Earnings and profitability are fleeting. The return on equity is low, and does not adequately compensate above the returns available on debt. The business is capital intensive, with low returns on capital and with very low profit margins.

If, the securities were cheap, on a bargain basis, then possibly a candidate may be located. Currently this is not the case with the average P/E ratio at 18.

CAPITALIZATION

Market Cap 60.72B

Enterprise Value 66.60B

Trailing P/E 28.90

Forward P/E 18.69

PEG Ratio (5 yr expected): 1.11

Price/Sales 2.45

Price/Book 2.13

Enterprise Value/Revenue 2.70

Enterprise Value/EBITDA 12.064

Capitalization structure is a very important component within the story of NWS-A & NWS.

The above figures representing Enterprise value are inaccurate. They are inaccurate for the reason that they do not take into account the “Off Balance Sheet” Operating Leases. These Operating Leases add some $5859.0 million to the effective debt. This is “potentially” a severe problem. The earnings are extremely volatile, and fluctuate wildly. Without a consistent margin above Interest on debt + Operating Leases, bankruptcy proceedings could be initiated by the “minority” bondholders.

How possible or likely is this?

It has happened once in the last five years, and been close on one other occasion.

Did the bondholders trigger bankruptcy? No, but they technically could have.

The second far more serious problem with the Capitalization resides within the Common stock itself.

There are two classes of Common stock; Class A and Class B.

Class A common stock represents the original common stock.

Class B common stock represents the converted Preferred Stock. This was converted on a 1 for 2 basis and was designed as a “Poison Pill” defense against NWS being acquired. Only Class B has voting rights, and thus control resides in one class of common stock that is held by Mr. Murdoch.

Therefore NWS is only going to be controlled by this one “unaccountable” owner. There will be no method by which the control of the company and its policies can be influenced by the other owners.

Holding NWS is therefore an examination of management and the strategies of management.

Have they been profitable and in the minority owners best interests?

INCOME STATEMENT

Profit Margin 8.84%

Operating Margin 15.59%

Return on Assets 5.25%

Return on Equity 9.65%

From the two margins we can ascertain that this business is just not that profitable. The Profit margin and Return on Equity are the two margins that flow to the Class-A common stock. They are poor. On aggregate the Profit Margin is 3.3%. This is not a profitable business.

Return on assets seemingly is high. This is very misleading.

The Return on Assets returns some $4.60 on investment. If we look at a different industry to get some perspective of what is possible, looking at OFIX the Return on Assets is $16.48. OFIX is also an “acquirer” of assets. The message being that you can buy high return assets that directly flow to the bottom line or you can buy low return assets. NWS tends to buy very low return assets.

The reason for such low profitability lies in the very high Costs associated with the business. Some 82% of gross revenues are consumed within the costs. Are there any discretionary cash-flows within the cost structure that are hidden, providing the margin of safety of redirecting them in time of need? Not at all, the Costs contain nothing that can be salvaged. This suggests poor negotiating on contracts with providers of content, be that the various sports bodies [NFL, NHL, etc]

The only discretionary cash-flows identified were found within Capital Expenditures. These amounted to $55.4 million or $0.01 per share.

BALANCE SHEET

Total Cash 5.32B

Total Cash Per Share 1.688

Total Debt 11.43B

Total Debt/Equity 0.401

Current Ratio 1.866

Book Value Per Share 9.021

Immediately there are problems that are highly visible that must call into question the advisability of NWS as an investment grade common stock.

The Current ratio falls below the minimum 2.0 required.

The debt is understated by the amount contracted to the Operating Leases.

The return on Retained Earnings has been 0.00%

This is unacceptable as an investment. It demonstrates unequivocally that the investment decisions under the incumbent management have destroyed shareholder value. The common stock is a pure speculation.

The Book Value resides in liquidation value only, and as such should be discounted by an appropriate rate as the demonstrated returns fall far below the purchase price paid. It is this either gross underperformance of purchased assets, or, poorly selected assets, combined with the poison pill defense that makes NWS such a dangerous investment.

SUMMARY

What do the Institutions think of NWS?

Well currently not that much.

Only some 10% of the float is owned by the Mutual Funds & Hedge Funds. This for such a large capitalization common stock is a very insignificant holding. I suspect the dual class of common stock is a negative in this age of owner activism. There is no way that value can be unlocked or increased without the management’s compliance.

The calculated Intrinsic Value = $0.00

Liquidation Value is the relevant valuation here, but has not been calculated.

The intricate capitalization structure designed to retain control of the business and thus the allocation of capital could be of benefit with the right management. With the incumbent management and demonstrated returns, it is an unmitigated disaster. I would advise looking elsewhere for an investment.

Ducati,

Thanx for that but I could not find the listing price of NWS amoungst it.

Maybee I should have been more clear. By listing price I meant issue price, Ie the price the stock floated at the time of listing, for example NAB listed at $1 per share. I would assume that NWS was similar but I would like an exact price if that is possible.

Thanx

Thanx for that but I could not find the listing price of NWS amoungst it.

Maybee I should have been more clear. By listing price I meant issue price, Ie the price the stock floated at the time of listing, for example NAB listed at $1 per share. I would assume that NWS was similar but I would like an exact price if that is possible.

Thanx

This one doesn't get any air play on this station but it just keeps going up !!!

Hit $31.00 intraday today , Smashed through 2 months of resistance @ $29 ish,

2 weeks ago on very solid volume. Wall st maybe taking a liking to it ???

Great exposure to the usa with out having to leave home.

All good news so long as you didn't buy @$55.00 in the good old tec days , who

knows it may get back there one day.

Holding atm average $22.

Hit $31.00 intraday today , Smashed through 2 months of resistance @ $29 ish,

2 weeks ago on very solid volume. Wall st maybe taking a liking to it ???

Great exposure to the usa with out having to leave home.

All good news so long as you didn't buy @$55.00 in the good old tec days , who

knows it may get back there one day.

Holding atm average $22.

http://au.biz.yahoo.com/070626/33/1ah2t.html

News Corp. reached an agreement in principle to safeguard the editorial integrity of the Wall Street Journal as part of its hostile takeover bid for Dow Jones, the Journal reported Tuesday.

The thorny issue of the Journal's independence has emerged as a key sticking point in News Corp.'s attempt to takeover Dow Jones for five billion dollars. The Journal is considered to be Dow Jones's most prized asset.

--------

this could see the NWS/NWSLV stock prices get to around AU$30, especially if News Corp. makes an acquisition such as Wall Street Journal.

(and NWS also has Myspace too. )

)

News Corp. reached an agreement in principle to safeguard the editorial integrity of the Wall Street Journal as part of its hostile takeover bid for Dow Jones, the Journal reported Tuesday.

The thorny issue of the Journal's independence has emerged as a key sticking point in News Corp.'s attempt to takeover Dow Jones for five billion dollars. The Journal is considered to be Dow Jones's most prized asset.

--------

this could see the NWS/NWSLV stock prices get to around AU$30, especially if News Corp. makes an acquisition such as Wall Street Journal.

(and NWS also has Myspace too.

- Joined

- 3 March 2007

- Posts

- 574

- Reactions

- 1

It's a media stock and there's the problem, its only moving because Murdoch is such an agressive CEO.

I think its looking nice for a short-term run, but accumulation wise is a no-no as the dividend disgusts me.

I think its looking nice for a short-term run, but accumulation wise is a no-no as the dividend disgusts me.

Similar threads

- Replies

- 15

- Views

- 2K

- Replies

- 55

- Views

- 13K

- Replies

- 129

- Views

- 15K