prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

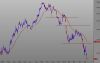

CEO's don't buy more shares in a company unless they are certain they know where its heading.

Why did Tamaya's (TMR) management buy pretty much all the way up then down? Before the co went bust....

Management get it wrong too. One could argue that they are too involved and may not step back and look at the bigger picture