- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Nickel Climbs for 11th Day as Stockpile Slump Curbs Supplies

July 12 (Bloomberg) -- Nickel rose for an 11th consecutive day in London as inventory declined, curbing supplies of the metal used to make stainless steel.

Stockpiles of nickel monitored by the London Metal Exchange fell 2.1 percent to 8,244 metric tons, the lowest since Aug. 22, the LME said today to a daily report. Inventory has dropped 78 percent this year. Stockpiled nickel may be needed by consumers to compensate for the production shortfall forecast for this year by some analysts.

``Supply concerns are back on the markets' minds for now,'' said Roy Carson, a London-based trader at Triland Metals Ltd., one of 11 companies trading on the floor of the LME. ``The psychology is quite bullish.''

Nickel for delivery in three months on the LME rose $450, or 1.8 percent, to $25,950 a metric ton at 9:47 a.m. London time. Earlier, the metal rose to $26,000, the highest since at least 1987. The metal has gained 91 percent this year.

``Nickel's out on its own,'' said Carson, who added that the metal could rise to between $27,000 and $28,000.

Credit Suisse Group said last month 2006 demand will outpace output by 15,000 tons. LME stockpiles are sufficient for three days of demand, Barclays Capital analysts led by Kevin Norrish said in a report yesterday.

``There are now very real concerns that many consumers will simply not get the nickel they require over the coming months,'' Barclays said.

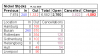

Among other LME metals, copper gained $230 to $8,140, lead rose $20 to $1,130, zinc added $80 to $3,600 and aluminum advanced $20 to $2,628. Tin was unchanged at $8,900.

July 12 (Bloomberg) -- Nickel rose for an 11th consecutive day in London as inventory declined, curbing supplies of the metal used to make stainless steel.

Stockpiles of nickel monitored by the London Metal Exchange fell 2.1 percent to 8,244 metric tons, the lowest since Aug. 22, the LME said today to a daily report. Inventory has dropped 78 percent this year. Stockpiled nickel may be needed by consumers to compensate for the production shortfall forecast for this year by some analysts.

``Supply concerns are back on the markets' minds for now,'' said Roy Carson, a London-based trader at Triland Metals Ltd., one of 11 companies trading on the floor of the LME. ``The psychology is quite bullish.''

Nickel for delivery in three months on the LME rose $450, or 1.8 percent, to $25,950 a metric ton at 9:47 a.m. London time. Earlier, the metal rose to $26,000, the highest since at least 1987. The metal has gained 91 percent this year.

``Nickel's out on its own,'' said Carson, who added that the metal could rise to between $27,000 and $28,000.

Credit Suisse Group said last month 2006 demand will outpace output by 15,000 tons. LME stockpiles are sufficient for three days of demand, Barclays Capital analysts led by Kevin Norrish said in a report yesterday.

``There are now very real concerns that many consumers will simply not get the nickel they require over the coming months,'' Barclays said.

Among other LME metals, copper gained $230 to $8,140, lead rose $20 to $1,130, zinc added $80 to $3,600 and aluminum advanced $20 to $2,628. Tin was unchanged at $8,900.