michael_selway

Coal & Phosphate, thats it!

- Joined

- 20 October 2005

- Posts

- 2,397

- Reactions

- 2

rederob said:MS

Your example shows a clear trend - 2.4% percentage point change in 3 days is not "negligible".

Another way of doing the maths on your scenario suggests that the variation was almost 25% in those 3 days, viz 2.4/9.6 - so isn't that an interesting take!

You can chart the rate of change, and with even "negligible" variations it may be possible to notice a "steady" trend, rather than a robust one.

If you are a daily follower of the fundamentals, these trends are often quite obvious.

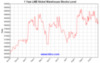

On the nickel front, it is blatantly obvious that the fundamentals are tightening more rapidly by the day, with an overnight cancellation accounting for over 6% of total warranted stock - bringing the cumulative share of cancelled to total stocks to 20%.

The problem we have with the maths as the denominator gets smaller, is that the statistics tend to become meaningless and should be ignored to a large degree: Concentrate on the raw numbers and trends.

The thing about Nickel is that LME supplies were much lower not that long ago, Aug 05