56gsa,

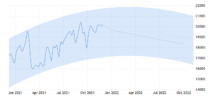

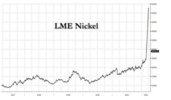

Yes I'm bullish on a lot of things, nickel included.

My assessment of MCR is a little different to the figures quoted going forward. They have plans well under way to increase production beyond those shown by some analyists. The stats you show would not alone convince me to back MCR. I hope they are wrong going forward. I think they need updating.

Yes I'm bullish on a lot of things, nickel included.

My assessment of MCR is a little different to the figures quoted going forward. They have plans well under way to increase production beyond those shown by some analyists. The stats you show would not alone convince me to back MCR. I hope they are wrong going forward. I think they need updating.