- Joined

- 21 April 2011

- Posts

- 61

- Reactions

- 0

Gindara-1 Update

'Coron Clastics' reservoir was encountered between 2907m and 3267.5m, a gross thickness of 360m. Interpreted to be water-wet. Minor mudlog gas readings.

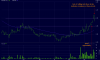

20% discount on this news. I assume this is a underground water cave which they have encountered on previous drills (id have to do some research on that).

Pretty heavy fall for something which i'd assume investors had factored in as likely being there. Casing and more drilling to follow.

'Coron Clastics' reservoir was encountered between 2907m and 3267.5m, a gross thickness of 360m. Interpreted to be water-wet. Minor mudlog gas readings.

20% discount on this news. I assume this is a underground water cave which they have encountered on previous drills (id have to do some research on that).

Pretty heavy fall for something which i'd assume investors had factored in as likely being there. Casing and more drilling to follow.