- Joined

- 8 April 2008

- Posts

- 871

- Reactions

- 0

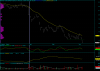

That being the case it has traded as low as $1.30 whilst a producer in 1997

Personally pretty well all bubbles---gold being a bubble retrace to their origin.

Half its current price isn't an impossibility.

I still cant see the sense in accumulating as a stock is falling.

Why don't people accumulate while its rising??

Always served me well?

My own personal valuation of NCM is that at POG US$1400/oz its share price ought to be $28. If the POG falls to US$1000/oz I still think the shares are worth $20. So on that basis (if my valuation methodology is sound) my opinion is that NCM is currently way oversold and I am happy to accumulate at prices below $20.

But who can pick the exact bottom of anything?

Of course I could be very wrong about all of this in which case you will be entitled to tell me so but it will not bother me because I am not scared of being wrong.