- Joined

- 20 November 2005

- Posts

- 787

- Reactions

- 92

Hi Ann,

The important element to consider here is to differentiate between trading and investing. This system is an investing method, so runs no more risks than a standard buy & hold portfolio concept. What is required to make this an outperformer is volatility and that is the key ingredient. Without volatility it dies.

If a stock is declining over a long period, as per your stage 4, then it will have the same risks as buying the stock as a long term investment. However, 2 major differences. Firstly, you do not invest 100% into the initial purchase which in turn means you will outperform a straight buy and hold should the price continue to drop. Secondly, if the stock drops, but does so on high volatility, then the system will trade around that volatility and can in fact be profitable even though the stock is falling.

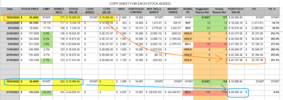

The method can be tested using a spreadsheet template I have. Feel free email me at nick_radge@reefcap.com and I'll happily forward it on.

Nick

The important element to consider here is to differentiate between trading and investing. This system is an investing method, so runs no more risks than a standard buy & hold portfolio concept. What is required to make this an outperformer is volatility and that is the key ingredient. Without volatility it dies.

If a stock is declining over a long period, as per your stage 4, then it will have the same risks as buying the stock as a long term investment. However, 2 major differences. Firstly, you do not invest 100% into the initial purchase which in turn means you will outperform a straight buy and hold should the price continue to drop. Secondly, if the stock drops, but does so on high volatility, then the system will trade around that volatility and can in fact be profitable even though the stock is falling.

The method can be tested using a spreadsheet template I have. Feel free email me at nick_radge@reefcap.com and I'll happily forward it on.

Nick