You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

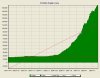

My SPI system

- Thread starter qichxi

- Start date

- Joined

- 2 September 2008

- Posts

- 1,038

- Reactions

- 1

Looks like you are using far too much leverage.

If that buy & hold turned out to be a losing trade the account would be history

If that buy & hold turned out to be a losing trade the account would be history

Wow qichxi, congratulations for posting your results! You are more likely to get a lot of respect here if you do that.

If you don't mind me asking, what is your average hold time? Do you scalp / day trade? Or, do you do this after work?

Martine

I hold one day.

I don't scalp/day trade. But I wanna after I build my auto-trading.

Trading is my interesting. It's after work.

Looks like you are using far too much leverage.

If that buy & hold turned out to be a losing trade the account would be history

The leverage is 25 due to ASX required.

If that buy & hold turned out to be a losing trade the account would be history? I don't understand,sorry my english.

account would be history?

What Beamstas means is that he thinks your account would be wiped out (become $0.00) if you use too much leverage, if the position goes against you.

What is "25" leverage? Does that mean you're putting in 25% of the contract value? How many contracts do you typically trade overnight? Do you use Interactive Brokers? Sorry for all the questions.

Btw, your average profit is 2x your average loss. Not bad for a part-time job

What Beamstas means is that he thinks your account would be wiped out (become $0.00) if you use too much leverage, if the position goes against you.

What is "25" leverage? Does that mean you're putting in 25% of the contract value? How many contracts do you typically trade overnight? Do you use Interactive Brokers? Sorry for all the questions.

Btw, your average profit is 2x your average loss. Not bad for a part-time job

I haven't power to choose leverage,SPI is ASX 200 futures.

I use IB and just one contract.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Thanks for sharing, qichxi.

When you say you hold 1 day do you buy on the open (9:50am) and sell at the close? Or do you trade the overnight movements due to your work?

It doesn't look like you use any stop loss? Would that have improved the results? Your biggest loss was quite big compared relative to your account size.

Interesting to see your system took no short trades during the real trade period, but the SPI has really just moved in a sideway whipsaw pattern for the last 2 months. Seem to suggest to me that your short signal is not being triggered?

Looks like good result. Well done and good luck.

When you say you hold 1 day do you buy on the open (9:50am) and sell at the close? Or do you trade the overnight movements due to your work?

It doesn't look like you use any stop loss? Would that have improved the results? Your biggest loss was quite big compared relative to your account size.

Interesting to see your system took no short trades during the real trade period, but the SPI has really just moved in a sideway whipsaw pattern for the last 2 months. Seem to suggest to me that your short signal is not being triggered?

Looks like good result. Well done and good luck.

- Joined

- 25 September 2007

- Posts

- 1,712

- Reactions

- 13

The max drawdown of $-736,640 on the buy&hold is a bit concerning

Is this a demo account system?

Is this a demo account system?

Thanks for sharing, qichxi.

When you say you hold 1 day do you buy on the open (9:50am) and sell at the close? Or do you trade the overnight movements due to your work?

It doesn't look like you use any stop loss? Would that have improved the results? Your biggest loss was quite big compared relative to your account size.

Interesting to see your system took no short trades during the real trade period, but the SPI has really just moved in a sideway whipsaw pattern for the last 2 months. Seem to suggest to me that your short signal is not being triggered?

Looks like good result. Well done and good luck.

The system can short but not good as buy in real trading. So I use buying in real.

I don't use stop loss though I can do that. If I have enough real history data I can analyse the stop amount.

I trade the overnight movements due to my work.

My account size is just for opening account, in fact, I have lots not in trading.

The MMD is better below 20% of account size (I prefer 5%) if account show for business issue.

The max drawdown of $-736,640 on the buy&hold is a bit concerning

Is this a demo account system?

The first is backtesting. But you don't need care MDD of buy & hold due to it's compare for this system in the software.

The MDD of buy system need be cared anytime.

rub92me

Don't look back

- Joined

- 24 April 2006

- Posts

- 1,071

- Reactions

- 6

Would be interesting to see how this long only system performed in say the period: November 2007 to March 2009. If it looks okay in that period then you may be on to something!

Would be interesting to see how this long only system performed in say the period: November 2007 to March 2009. If it looks okay in that period then you may be on to something!

please see the period,feel stable.

Attachments

rub92me

Don't look back

- Joined

- 24 April 2006

- Posts

- 1,071

- Reactions

- 6

So you traded 1 contact overnight on the SPI, holding for 1 night and your average win was > 1500 or > 60 points in that period. I don't think even in hindsight you could create the results you've shown with the SPI data I have. All the best anyway.

So you traded 1 contact overnight on the SPI, holding for 1 night and your average win was > 1500 or > 60 points in that period. I don't think even in hindsight you could create the results you've shown with the SPI data I have. All the best anyway.

have you that period real histroy data? I can backtest.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

So you traded 1 contact overnight on the SPI, holding for 1 night and your average win was > 1500 or > 60 points in that period. I don't think even in hindsight you could create the results you've shown with the SPI data I have. All the best anyway.

Feels wrong doesn't it. But his buy and hold strategy (which I assume is for reference only) showed a $581K loss. On $25 per tick that equates to 23,000 points. So something wrong there...either it was more than $25 per tick, or it's not the SPI.

- Joined

- 2 September 2008

- Posts

- 1,038

- Reactions

- 1

Feels wrong doesn't it. But his buy and hold strategy (which I assume is for reference only) showed a $581K loss. On $25 per tick that equates to 23,000 points. So something wrong there...either it was more than $25 per tick, or it's not the SPI.

Or more than 1 contract

Feels wrong doesn't it. But his buy and hold strategy (which I assume is for reference only) showed a $581K loss. On $25 per tick that equates to 23,000 points. So something wrong there...either it was more than $25 per tick, or it's not the SPI.

HI,It's SPI from Yahoo data.

So I do want have real history data.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

What's the code for yahoo's SPI data? Can't find it.

I do have real data on a chart but can't download it for you.

I do have real data on a chart but can't download it for you.

Similar threads

- Replies

- 0

- Views

- 464

- Replies

- 8

- Views

- 775

- Replies

- 21

- Views

- 3K