- Joined

- 28 May 2004

- Posts

- 10,895

- Reactions

- 5,392

Re: MUL - Where to from here?

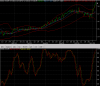

Bollinger bands are contracting again, indicating the possibility of another break out. This chart is only up until the end of trade yesterday (Wed 10/11/04). A look at a dynamic chart today shows the bands continuing to tighten.

Incidentally, this is the first time since February that we have seen the Bollinger bands for MUL curve upwards.

It all points to some interesting times ahead for MUL.

Bollinger bands are contracting again, indicating the possibility of another break out. This chart is only up until the end of trade yesterday (Wed 10/11/04). A look at a dynamic chart today shows the bands continuing to tighten.

Incidentally, this is the first time since February that we have seen the Bollinger bands for MUL curve upwards.

It all points to some interesting times ahead for MUL.