I don't think that you have missed the boat at all. MPO has a very experienced management team and has a lower price per resource unit than many competitors.

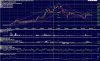

The Baillieu report (see link below) contains a very limited summary in that regard, but there has been progress since then. Its target price of .45 was being approached ( a high of .345 I think) and the stock suffered from the general international subprime problems from 9 August 2007. However, there appears now to be greater optimism that those can be contained.

Whether that is right or not (and we cannot really tell how deep the subprime problems are), it does now seem clear from the latest Chinese GDP / inflation / wealth statistics that Chinese growth and energy demands continue unabated, and Molopo is ver well placed with its Chinese JV partner and interest in the Liulin area to play a part in that. Even a minor role in the Chinese region can result in a $1 bil cap company (a 5 times increase over the curren cap).

In short the Baillieu report is conservative in its .45 estimate but does perhaps correctly call it a short term speculative buy, given the trading patterns re small cap companies. However, it is assisted by good fundamentals and that makes it a good mid / long term investment as well.

Baillieu considered the reserve / market cap ratio to be the lowest in the sector at .26. It is still in a similar position (now .21) and will stand to gain well from recovery and further interest in the Au. resource sector, a sector that is gaining increasing international interest.

Its board includes Ian Gorman from BHP, and an ability to make and exploit both international resouce connection and international investors.

In short, even if there are further subprime issues, this sector and company are well placed. I disclose shareholdings in this company.

http://www.molopo.com.au/broker_report_16_7_07.pdf

The Baillieu report (see link below) contains a very limited summary in that regard, but there has been progress since then. Its target price of .45 was being approached ( a high of .345 I think) and the stock suffered from the general international subprime problems from 9 August 2007. However, there appears now to be greater optimism that those can be contained.

Whether that is right or not (and we cannot really tell how deep the subprime problems are), it does now seem clear from the latest Chinese GDP / inflation / wealth statistics that Chinese growth and energy demands continue unabated, and Molopo is ver well placed with its Chinese JV partner and interest in the Liulin area to play a part in that. Even a minor role in the Chinese region can result in a $1 bil cap company (a 5 times increase over the curren cap).

In short the Baillieu report is conservative in its .45 estimate but does perhaps correctly call it a short term speculative buy, given the trading patterns re small cap companies. However, it is assisted by good fundamentals and that makes it a good mid / long term investment as well.

Baillieu considered the reserve / market cap ratio to be the lowest in the sector at .26. It is still in a similar position (now .21) and will stand to gain well from recovery and further interest in the Au. resource sector, a sector that is gaining increasing international interest.

Its board includes Ian Gorman from BHP, and an ability to make and exploit both international resouce connection and international investors.

In short, even if there are further subprime issues, this sector and company are well placed. I disclose shareholdings in this company.

http://www.molopo.com.au/broker_report_16_7_07.pdf