Hi All,

Just looking for some discussion on the following:

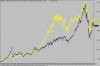

I'd always understood that the Aus equity markets followed the US quite closely - this is demonstrated fairly easily be looking at the correlation between a US index and the All Ords for example. I was also under the impression that movements in the US (for example a higher close) would have an effect here - you're always hearing that stocks here moved higher or lower based on a strong or weak lead from the US. I understand the limited value of the financial press and that explaining movements after the fact is easy and often pointless, but in this case it always seemed rational; the US is the largest economy on the planet, and it's health will have an effect on the rest of us. Fair enough. If the US had a good day, then we have a higher probability of having a good one.

Now for the problem. I've had a quick look at the relationship between the movement in the US indices and the XAO the next day and i find it's practically nil (it is only just positive over 20 years with extended periods where the correlation is negative - up days in the US are followed by down days here on average). Am i missing something? Has anybody else had a look at this? Shouldn't an up day on the US indices at least have some postive correlation to an up day here? Granted, I haven't done a full analysis yet but I would have thought that the relationship would be strong enough to show itself from a fairly simple test (does an up day on the S&P500, DOW or NASDAQ result in a higher probability of an up day on the XAO - it doesn't seem to)?

If this is simply a case of beleiving it because I've heard the press say it so many times, I'd be very surprised.

Any thoughts appreciated.

AMSH

Just looking for some discussion on the following:

I'd always understood that the Aus equity markets followed the US quite closely - this is demonstrated fairly easily be looking at the correlation between a US index and the All Ords for example. I was also under the impression that movements in the US (for example a higher close) would have an effect here - you're always hearing that stocks here moved higher or lower based on a strong or weak lead from the US. I understand the limited value of the financial press and that explaining movements after the fact is easy and often pointless, but in this case it always seemed rational; the US is the largest economy on the planet, and it's health will have an effect on the rest of us. Fair enough. If the US had a good day, then we have a higher probability of having a good one.

Now for the problem. I've had a quick look at the relationship between the movement in the US indices and the XAO the next day and i find it's practically nil (it is only just positive over 20 years with extended periods where the correlation is negative - up days in the US are followed by down days here on average). Am i missing something? Has anybody else had a look at this? Shouldn't an up day on the US indices at least have some postive correlation to an up day here? Granted, I haven't done a full analysis yet but I would have thought that the relationship would be strong enough to show itself from a fairly simple test (does an up day on the S&P500, DOW or NASDAQ result in a higher probability of an up day on the XAO - it doesn't seem to)?

If this is simply a case of beleiving it because I've heard the press say it so many times, I'd be very surprised.

Any thoughts appreciated.

AMSH