- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

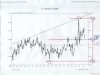

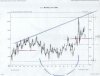

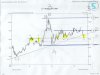

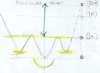

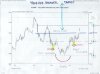

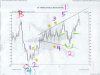

The purpose of this information is to illustrate the trading of Elliot Wave methodology . Combined with Fibonacci Retracement levels which is highly subjective .....

To become proficient in Eliiott Waves methodology , it is an acquired skill through observation , time, and human behavior …

So , if you are the type of person who is always looking for what’s easier , then this may not be for you . It is this very attitude that’s basis of so many people who try their hand at the Elliott Wave method.

If you do not trade the Elliot Wave theory and just as important have an understanding of Fibonacci Retracements , then theses posts will not make much sense to you ....

You will need to read about Fibonacci Retracements in order to truly

understand the levels themselves ,,,, Read especially about whats called THE GOLDEN RATIO . With this understanding you can truly uderstand where to place stops and control you risk when the particular market moves against you ...

Not all levels hold up as support .... again , it is subjective ......

That's where the use of Risk to Reward comes in because it is not 100 % ....

In fact no trading methodolgy out there is 100 % ..

It's all about probabilty....

What I am showing you in these pages that are posted did not come easy . It's taken a liitle over 2 years .. to do ......

Bottom line , if you do not trade Elliott Waves theory and have no understanding of Fibonacci Retracement Levels you are lacking information to truly appreciate the posts ...

Weekly and Monthy charts are more significant and more Important than the Daily or Intraday charts … The main reason why this is true is because all the market noise is in the day charts and the intraday charts …. They gap up or down on the open which is not that apparent on longer term charts in comparison . It is just the way that it is ..

To become proficient in Eliiott Waves methodology , it is an acquired skill through observation , time, and human behavior …

So , if you are the type of person who is always looking for what’s easier , then this may not be for you . It is this very attitude that’s basis of so many people who try their hand at the Elliott Wave method.

If you do not trade the Elliot Wave theory and just as important have an understanding of Fibonacci Retracements , then theses posts will not make much sense to you ....

You will need to read about Fibonacci Retracements in order to truly

understand the levels themselves ,,,, Read especially about whats called THE GOLDEN RATIO . With this understanding you can truly uderstand where to place stops and control you risk when the particular market moves against you ...

Not all levels hold up as support .... again , it is subjective ......

That's where the use of Risk to Reward comes in because it is not 100 % ....

In fact no trading methodolgy out there is 100 % ..

It's all about probabilty....

What I am showing you in these pages that are posted did not come easy . It's taken a liitle over 2 years .. to do ......

Bottom line , if you do not trade Elliott Waves theory and have no understanding of Fibonacci Retracement Levels you are lacking information to truly appreciate the posts ...

Weekly and Monthy charts are more significant and more Important than the Daily or Intraday charts … The main reason why this is true is because all the market noise is in the day charts and the intraday charts …. They gap up or down on the open which is not that apparent on longer term charts in comparison . It is just the way that it is ..