- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

I posted a few times the market cap/gdp ratio charts in another thread but I figured might as well start a new one.

Data sources:

To be clear

Valuations are not a market timing tool.

Valuations don't provide good info on the path of future short/medium term (1-3y) returns.

Valuations tend to be very good at providing info on path of future long term (5-12y) returns.

Just because valuations are cheap does not mean they cannot get cheaper in the short/medium term.

Just because valuations are expensive does not mean they cannot get more expensive in the short/medium term.

Total Market Cap/GDP is just one of many valuation ratios which are really just a short-hand way to express the present value of future cash flows.

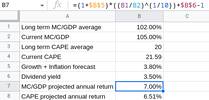

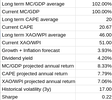

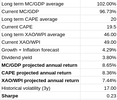

Using the most recent released numbers of Sep 2020 Market Cap and Sep 2020 GDP we are at ~100 TMC/GDP:

According to the Nov 2020 RBA Statement on Monetary Policy they forecast Dec 2020 GDP to be a -4% YoY from Dec 2019:

https://www.rba.gov.au/publications/smp/2020/nov/economic-outlook.html (see Table 6.1)

So using 0.96*Dec 2019 GDP and Nov 2020 Market Cap to impute a Dec 2020 forecast for TMC/GDP puts us at ~113% TMC/GDP, in line with GuruFocus numbers.

This is just a forecast for that value and we won't know for sure until Dec 2020 GDP and TMC numbers are released, but probably pretty close.

Which means we have gone from valuations in March equal to the 2002, 2008, 2011 bottoms (cheap and associated with strong forward long term returns) to valuations today equal to 2007 (expensive and associated with weak forward long term returns).

GuruFocus currently has their TMC/GDP at ~113%, so make of that what you will.

Data sources:

- ASX total market cap - https://www2.asx.com.au/about/market-statistics/historical-market-statistics (unfortunately the new ASX website only has data going back to 2010, I have saved data from their old website going back to early 2002).

- GDP - https://www.rba.gov.au/statistics/tables/#output-labour (Gross Domestic Product and Income – H1, I use data series GGDPECCPGDP)

To be clear

Valuations are not a market timing tool.

Valuations don't provide good info on the path of future short/medium term (1-3y) returns.

Valuations tend to be very good at providing info on path of future long term (5-12y) returns.

Just because valuations are cheap does not mean they cannot get cheaper in the short/medium term.

Just because valuations are expensive does not mean they cannot get more expensive in the short/medium term.

Total Market Cap/GDP is just one of many valuation ratios which are really just a short-hand way to express the present value of future cash flows.

Using the most recent released numbers of Sep 2020 Market Cap and Sep 2020 GDP we are at ~100 TMC/GDP:

According to the Nov 2020 RBA Statement on Monetary Policy they forecast Dec 2020 GDP to be a -4% YoY from Dec 2019:

https://www.rba.gov.au/publications/smp/2020/nov/economic-outlook.html (see Table 6.1)

So using 0.96*Dec 2019 GDP and Nov 2020 Market Cap to impute a Dec 2020 forecast for TMC/GDP puts us at ~113% TMC/GDP, in line with GuruFocus numbers.

This is just a forecast for that value and we won't know for sure until Dec 2020 GDP and TMC numbers are released, but probably pretty close.

Which means we have gone from valuations in March equal to the 2002, 2008, 2011 bottoms (cheap and associated with strong forward long term returns) to valuations today equal to 2007 (expensive and associated with weak forward long term returns).

GuruFocus currently has their TMC/GDP at ~113%, so make of that what you will.

Last edited by a moderator: