Hi all,

As a BuyAndHolder, got slaughtered in 2008 so took an interest in figuring out how to exit in the future in time to salvage some profits.

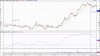

Came across a longterm Stochastic indicator which I've been testing with Bullcharts and TradeSim on weekly data, with promising ten-year historical results over the All Ords.

BuyAndHolders rarely use stops, and I found that with this exercise, any stop I tried in TradeSim decreased net profits, win rates, and average profit per trade. But an exit based only on the longterm stochastic worked.

The exercise is contrarian, and very unsophisticated: Enter long on Monday's open when %k of the stochastic(55,39,3) crossed above 20. Exit long on Monday's open when %k of the stochastic(55,39,3) crossed below 80.

The exercise pretended I had $204000 capital at the start. Brokerage is $30 per transaction ($60 per round trip). Example 1 invested up to 34 positions maximum at $6000 each. Example 2 (pyramid profits) invested up to 33 positions maximum at 3% of the total capital at the time. Thus with no stop, my risk per position was around 3% of capital, being 100% of each position. Stop Loss purists will have a field day with that!

Trade Sim excludes open trades, so if any were going to be a loss, accumulated profits would be reduced accordingly. However,balancing that, virtually no trades would have been entered during 2008.

The Trade Sim simulation results do not include the beneficial impact of dividends which would be received given the longterm holding periods.

I tried different ASX subsets and starting dates to try and pick up different companies, results were always similar. I have just the standard Trade Sim version, so could not attempt a "Monte Carlo" test.

Trade Sim detailed simulation reports for two examples are attached (I hope) in case anyone finds them of interest. Comments and suggestions welcome, especially from any other ASF members who prefer a long-term trading or investing timeframe.

Also, if any members have Trade Sim, and access to other stock exchange data, would anyone care to test the exercise to see if the results are similar to the ASX All Ords? I've already tested the NZX, and found it similarly profitable, but far too few transactions to be certain.

dougy

As a BuyAndHolder, got slaughtered in 2008 so took an interest in figuring out how to exit in the future in time to salvage some profits.

Came across a longterm Stochastic indicator which I've been testing with Bullcharts and TradeSim on weekly data, with promising ten-year historical results over the All Ords.

BuyAndHolders rarely use stops, and I found that with this exercise, any stop I tried in TradeSim decreased net profits, win rates, and average profit per trade. But an exit based only on the longterm stochastic worked.

The exercise is contrarian, and very unsophisticated: Enter long on Monday's open when %k of the stochastic(55,39,3) crossed above 20. Exit long on Monday's open when %k of the stochastic(55,39,3) crossed below 80.

The exercise pretended I had $204000 capital at the start. Brokerage is $30 per transaction ($60 per round trip). Example 1 invested up to 34 positions maximum at $6000 each. Example 2 (pyramid profits) invested up to 33 positions maximum at 3% of the total capital at the time. Thus with no stop, my risk per position was around 3% of capital, being 100% of each position. Stop Loss purists will have a field day with that!

Trade Sim excludes open trades, so if any were going to be a loss, accumulated profits would be reduced accordingly. However,balancing that, virtually no trades would have been entered during 2008.

The Trade Sim simulation results do not include the beneficial impact of dividends which would be received given the longterm holding periods.

I tried different ASX subsets and starting dates to try and pick up different companies, results were always similar. I have just the standard Trade Sim version, so could not attempt a "Monte Carlo" test.

Trade Sim detailed simulation reports for two examples are attached (I hope) in case anyone finds them of interest. Comments and suggestions welcome, especially from any other ASF members who prefer a long-term trading or investing timeframe.

Also, if any members have Trade Sim, and access to other stock exchange data, would anyone care to test the exercise to see if the results are similar to the ASX All Ords? I've already tested the NZX, and found it similarly profitable, but far too few transactions to be certain.

dougy