>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

don't buy shares!  :

:

if u do, don't buy off the first minor rally!

if u do, don't buy off the first minor rally!

I learnt to try and identify market movements prior to the crash. I had liquidated a lot before the correction in Aug, bought back in and sold most again arounf November. In hindsight I should have waxed the lot and shorted the shizen out of every indices possible.

I also learnt that even in bad times you have 1-2 days to get out, like this crash, it has been a slow motion train wreck, there was plenty of time until last two days to get out.

I also learnt to sell into strength on a bounce, massive short covering and euphoria this morning pushed the market up and smart money sold into the rise IMO.

Attempting to identify market peaks and bottoms are highly un-reliable in today's complex financial environment. Statistics show only 10% of success at most, which means you will get it wrong 9 out of 10 times. And no reputable investor will ever recommend this technique.

If you think you have learnt to accurately identify market movements, all I could say is you haven't learnt anything positive.

From Fat Prophets. A good read for many of us here.

For example, in August last year, just as the US sub-prime crisis was first emerging, the All Ordinaries Index was actually down on the year. It eventually finished up 14% for 2007. At that point in time, it was all doom and gloom. Just as it is now.

Strategies during a correction.

1. Topping up

2. buying at a bottom

will get u a headache at the very best.

Strategies during a bear market should be IMO

1. Waiting for the volatility to go away before getting back in

2. Holding on to what you have OR getting out.

This is not a market that should be played right now.

And if so... let the investors know that it is one BIG GAMBLE!

At what point do we concede that this is a bear market.

It is as if people need to see a one day crash similar to 1987... before they realise the cat has hit the fan... and there is nothing left for a bounce.

stop acting on the say so of others but take heed of what they say. Do your own research and look after your capital.

Doesn't that just sum it all up nicely in one concise sentence!

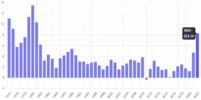

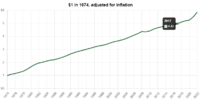

In the 694 days between 11 January 1973 and 6 December 1974, the New York Stock Exchange's Dow Jones Industrial Average benchmark suffered the seventh-worst bear market in its history, losing over 45% of its value.[2] 1972 had been a good year for the DJIA, with gains of 15% in the twelve months. 1973 had been expected to be even better, with Time magazine reporting just 3 days before the crash began that it was 'shaping up as a gilt-edged year'.[3] In the two years from 1972 to 1974, the American economy slowed from 7.2% real GDP growth to −2.1% contraction, while inflation (by CPI) jumped from 3.4% in 1972 to 12.3% in 1974.[1]

1973–1974 stock market crash - Wikipedia

en.wikipedia.org

The effect was worse in the United Kingdom, particularly on the London Stock Exchange's FT 30, which lost 73% of its value during the crash.[4] From a rate of 5.1% real GDP growth in 1972, the UK went into recession in 1974, with GDP falling by 1.1%.[1] At the time, the UK's property market was going through a major crisis, and a secondary banking crisis forced the Bank of England to bail out a number of lenders.[5] In the United Kingdom, the crash ended after the rent freeze was lifted on 19 December 1974, allowing a readjustment of property prices; over the following year, stock prices rose by 150%. The definitive market low for the FT30 Index (a forerunner of the FTSE100 today) came on 6 January 1975, when the index closed at 146 (having reached a nadir of 145.8 intra-day). The market then practically doubled in just over 3 months.[5] However, unlike in the United States, inflation continued to rise, to 25% in 1975, giving way to the era of stagflation. The Hong Kong Hang Seng Index also fell from 1,800 in early 1973 to close to 300.[6]

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.