- Joined

- 24 December 2005

- Posts

- 2,601

- Reactions

- 2,065

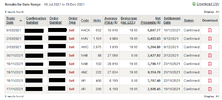

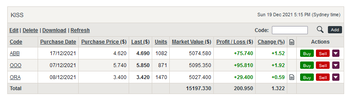

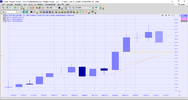

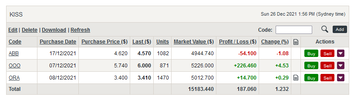

Just for fun, I thought I would try for a portfolio of 10 shares/ETFs built up over three months and held until they break through a vital trendline/resistance and get sold. This will all be done manually with IC charts. I will eyeball the charts, draw my support and resistance trendlines and see how we go. I like to chart in the simplest way possible hence the reason I say KISS = Keep it Simple Sweetheart/Stupid!

I am not here to teach or bang on like an expert, this is just for a bit of fun and not to be taken too seriously, nor is it a recommendation for any stocks selected. If you get something from it...awesome! I will put up my charts and give my reasons for an entry and an exit along the way. My broker (Westpac) has a little window that will show holdings and percentage gain/loss but there will not be any great fancy windows of P&L hence adhering to the concept of keeping it simple!

I will probably post once a week to see how we are travelling, unless I get bored, sick or if I find it is putting me off my game, then I won't!

I do have an ulterior motive, I want to improve my close (now adhering to that other wonderful sales hint ABC = Always Be Closing ) and not give back more than I have to, to the market. I just sold six shares (with none in loss) from November 2020 because they broke through a resistance line. I did a tally and only came away with a combined profit of 13.5%, piss poor in my opinion. Let's see if we can improve our trendlines lines and better that!

I am not here to teach or bang on like an expert, this is just for a bit of fun and not to be taken too seriously, nor is it a recommendation for any stocks selected. If you get something from it...awesome! I will put up my charts and give my reasons for an entry and an exit along the way. My broker (Westpac) has a little window that will show holdings and percentage gain/loss but there will not be any great fancy windows of P&L hence adhering to the concept of keeping it simple!

I will probably post once a week to see how we are travelling, unless I get bored, sick or if I find it is putting me off my game, then I won't!

I do have an ulterior motive, I want to improve my close (now adhering to that other wonderful sales hint ABC = Always Be Closing ) and not give back more than I have to, to the market. I just sold six shares (with none in loss) from November 2020 because they broke through a resistance line. I did a tally and only came away with a combined profit of 13.5%, piss poor in my opinion. Let's see if we can improve our trendlines lines and better that!