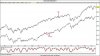

After last night I get the feeling that we are going to head into that much talked about market correction.

With concerns ongoing about the oil price, rising interest rates, inflation and the US housing market. We might have reached a point where the market takes that long needed break to refresh.

Over the last couple of months the market has had a couple of short sharp sell downs, only to head higher again.

But this time I have a feeling that it could last a bit longer.

Don't get me wrong I don't think long term the market will fall apart, but I am making sure I have plenty of cash on hand to pick up any bargains that present themselves over the next couple of weeks.

Would be interested to hear peoples thoughts!!!

With concerns ongoing about the oil price, rising interest rates, inflation and the US housing market. We might have reached a point where the market takes that long needed break to refresh.

Over the last couple of months the market has had a couple of short sharp sell downs, only to head higher again.

But this time I have a feeling that it could last a bit longer.

Don't get me wrong I don't think long term the market will fall apart, but I am making sure I have plenty of cash on hand to pick up any bargains that present themselves over the next couple of weeks.

Would be interested to hear peoples thoughts!!!