- Joined

- 9 July 2006

- Posts

- 6,027

- Reactions

- 1,663

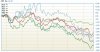

There was a good article in the AFR this weekend regarding FMG.

FMG needs the price of iron ore to be around at '$100 per ton' mark to fund it's mines and service debt levels, but only for he next 12 months or so. l'm sure they will manage, but it will still be interesting to see how they go if...

FMG needs the price of iron ore to be around at '$100 per ton' mark to fund it's mines and service debt levels, but only for he next 12 months or so. l'm sure they will manage, but it will still be interesting to see how they go if...