- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,897

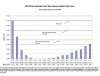

Eurozone interest rates fell 0.5% Thursday to 2.0%.

Annual inflation in the 15 countries making up the zone, fell from 2.1% to 1.6% in December. ( this rate reduction also affects Slovakia, the recent 16th member to adopt the euro currency, in January 09).

It was confirmed that the Eurozone has been in recession since September 2008.

Annual inflation in the 15 countries making up the zone, fell from 2.1% to 1.6% in December. ( this rate reduction also affects Slovakia, the recent 16th member to adopt the euro currency, in January 09).

It was confirmed that the Eurozone has been in recession since September 2008.