over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,524

- Reactions

- 8,091

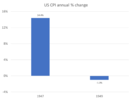

It's the first one this year that hasn't been above estimates so it's literally the first one this year where it's looked like the fed has actually gotten things under control.Merely devastating versus catastrophic...

Bullish?

all about the narrative , am looking to see if they have 'tweaked' the CPI calculations again ( and i wouldn't be shocked if it has been 'adjusted ' )Interesting article before release of cpi figures:

Hint: no improvement, core figures as BAD as expected yet: party time.yeahh absolutely crazy:

Don't be fooled by a drop in U.S. headline inflation. Markets will be attuned to another figure on Wednesday.

The core CPI reading, or measure which strips out volatile food and energy costs, could have the propensity to jolt markets after Wednesday's release.www.marketwatch.com

Figures released are BAD...

Adjusted?? I am shocked, shocked I tell you!all about the narrative , am looking to see if they have 'tweaked' the CPI calculations again ( and i wouldn't be shocked if it has been 'adjusted ' )

www.sharecafe.com.au

www.sharecafe.com.au

View attachment 145212

What it means

At a time when many commentators are grappling to find an analogy to explain the current inflation episode, we believe it’s worth considering what happened in the United States in 1947.

At the time, the US was beginning to recover from global disruption caused by WWII. Global productive capacity, which had previously been focused on (or destroyed by) the war, struggled to supply post-war consumer demand as soldiers returned home from Europe and the Pacific. Additionally, wartime price controls were removed. Two years later, the US CPI was +14.4%. By 1949, the change in CPI fell to a -1.0%.

Was this decrease driven by a large rate hike cycle enacted by a hawkish Federal Reserve?

No. In fact, the Fed’s 12-month rate increased only slightly from 0.75% in July 1947 to 1.25% in Aug 1948. The real driver was the natural expansion and recovery of US / global productive capacity after a traumatic disruption to normal operations.

Looking back, the 1947 inflation was clearly transitory (despite the two-year lag in CPI data). It begs the question: will we come to the same conclusion with the current inflation episode?

12 Charts We’re Thinking About Right Now - Sharecafe

Quay Global uses a series of handy charts to add some much-needed context to the latest trends in housing, retail and venture capital – and what they mean for investors.www.sharecafe.com.au

Probably down, inflation expectations have been decreasing in the US too

Demand side unlikely to rise much until the winter thaw of next year. Supply side is a whole different question/shitshow.Clearly petrol/gas/crude prices are driving this. Inflation expectations & CPI seem to have peaked globally - for now. Not sure where the markets are going with this.

Inflation remains high and the Fed will likely continue to hike. CME Fedwatch tool says that 50bps hike is most likely (57%) v. 75bps (43%). Yield curve remains inverted. Consumers increasing dependent on credit cards to pay for inflation. US Tech has been laying off employees in significant numbers. A number of commentators (hedge fund managers) suspect the US is, or will be, in a recession.

The main question will be whether or not price of oil can begin to head upwards again. Interested to hear what @over9k and @Smurf1976 have to say...

Demand side unlikely to rise much until the winter thaw of next year. Supply side is a whole different question/shitshow.

On the demand side, we also have the massive curveball of the china lockdowns to contend with, very difficult to say what will happen there (will they just stop bothering at some point?) or what. Hard to say on that one.

Nothing I've read or seen (no person, no data point, nothing) suggests that the supply side is going to improve. Even the saudi's are pumping at almost full capacity. Unless there's some kind of plan to get libya and/or venezuela back online in the next few months, we're in quite the pinch.

doubt.jpgWhat about EU initiatives to reduce their reliance on fossil fuels?

doubt.jpg

View attachment 145230

"A bill providing the legal basis to burn more coal for power generation is now making its way through parliament, aiming to boost the output of so-called reserve power plants that are irregularly used for grid stabilization and were scheduled to go offline over the next few years.

In addition, power plants that were already mothballed under the phaseout plan but are still technically operational are to be brought back online. Those so-called plants of last resort usually burn more polluting lignite from mines in eastern Germany.

Kerstin Andreae, head of the German Association of Energy and Water Industries, told German public broadcaster ARD on Monday that reserve power plants burning German lignite can be brought online in "a relatively short time span." Those using hard coal for electricity generation would need coal imports from abroad, she said.

Germany closed its last remaining hard coal mine in 2018, and has since relied on Russia for half of its needs of the fossil fuel. "Russian coal can be completely replaced by other countries in a few months. Especially from the US, Colombia and South Africa," Alexander Bethe, board chairman of the Association of Coal Importers, said in a statement.

While parliament is scheduled to vote on the coal bill by July 8, the government has made it clear that the revival of the fossil fuel in Germany will last only until March 2024. By that time, Berlin wants to have Russian gas supplies reduced to about 10%, from 55% before the war and 35% currently...

The new measures come amid heightened German efforts to buy so-called liquefied natural gas (LNG) on the world market — an increasingly crowded trade, given that other countries are also eager to cut their gas dependence on Russia. For that, Germany is planning to use floating regasification plants, because it doesn't have any of the facilities needed to import LNG".

Europe has been blighted with leftism and leftists are idiots.

There's really only two other places they can get their petrochemicals from - usa and middle east. France loves nuclear but they're the only ones that do so aside from the green energy that oh my god, wouldn't you know it, DOES NOT WORK, it's back to fossil fuels.

Venezuela's gone, libya's gone, and they're doing everything they can to get off russia as fast as possible. There's only two real suppliers left after that and the saudi's taps are almost running flat out already, so that only leaves the americans.

I'm very bullish over the medium termI'm sure I read that Russia was halting coal supply to the EU too....

Seems like the next down leg is only delayed until fossil fuel prices head up for the winter.

China inflation at 2.7% for the previous month, albeit less than the expected 2.9% that's 32% annualised. That's despite rolling lockdowns. Holy ???

Consist in importing US shale oil/gas and restarting coal stations so far..and cold shower/switching lights and factories/central heating off. Good luck EUWhat about EU initiatives to reduce their reliance on fossil fuels?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.