over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,420

- Reactions

- 7,841

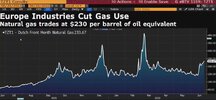

Powell's giving his half-yearly testimony. Republicans are on a tear. He's not wrong about this though - the yanks are the best/most insulated country probably outside of norway and the arabs.

Doesn't mean the situation's exactly "good" though, it's just the best of a bad bunch.

Biggest curveball still remains the U.S president curtailing some or all of yank oil exports.