- Joined

- 28 May 2020

- Posts

- 7,050

- Reactions

- 13,718

The US PPI was released last night, and not surprisingly, was up big tim.

From Invesopedia

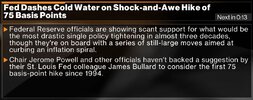

This transitory Inflation is putting a new meaning to the word Transitory.

How long does it take for Inflation to keep rising before the Fed heads and others who trotted out the tag line admit they got it wrong??

Mick

From Invesopedia

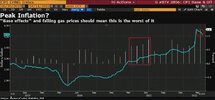

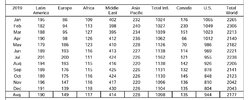

As has occurred with the CPI figures, the rate of increase has been rising steadily, so there is plenty in the pipeline.In March 2022, the Producer Price Index (PPI) for final demand increased by 1.4% on a seasonally adjusted basis. This follows monthly increases of 1.2% in January 2022 and 0.9% in February. On an unadjusted basis, the PPI has risen by 11.2% for the 12 months ending in March 2022, the largest 12-month increase since the data was first compiled in this manner in November 2010.1

The monthly rise of 1.4% in March also equates to a compound annualized growth rate (CAGR) of 18.2%. In general, the PPI is a gauge of inflation that measures increases to input costs faced by the producers of goods and services. Because it measures price changes before they reach consumers, some analysts see it as an earlier predictor of inflation than the CPI.

KEY TAKEAWAYS

- The Producer Price Index (PPI) for final demand was up by 1.4% in March 2022.

- It has risen by 11.2% over the past 12 months, and the current annualized pace is 18.2%.

- This follows monthly increases of 1.2% in January and 0.9% in February.

- The index for goods was up by 2.3% in March, and the index for services rose by 0.9%.

- Higher consumer price inflation may be ahead.

High Level Detail

In March 2022, driving the overall rise of 1.4% in the PPI for final demand was an increase of 2.3% for final demand goods. The index for final demand services was up by 0.9%. Prices for final demand less foods, energy, and trade services increased 0.9% in March 2022, the largest advance since the 1.0% rise in January 2021. For the 12 months ending in March 2022, the index for final demand less foods, energy, and trade services moved up by 7.0%.1

This transitory Inflation is putting a new meaning to the word Transitory.

How long does it take for Inflation to keep rising before the Fed heads and others who trotted out the tag line admit they got it wrong??

Mick