- Joined

- 28 August 2022

- Posts

- 9,004

- Reactions

- 14,746

For as long as I can remember, politicians only have one mantra. Number 1 first and foremost, and if anything happens to benefit the peasants/masses, then we won't let that happen again!!!There's no vision in politics anymore, just short term cynical populism. I think I've mentioned before about governments thinking one election cycle at a time with a focus on doing only what is necessary to get them re-elected... and that's where it ends.

Morrison blew $5.5 billion on a submarine deal that fell through. Imagine the infrastructure that could have been maintained or built with that money. A big part of the problem is that people are so focused on partisan politics that we don't hold governments to account. We make excuses for our own political tribe and bash the other mob. Politicians are very aware of this and encourage the rabid tribalism. if you can make human nature work for you, all the better.

I fear this thread is veering off topic now. Perhaps any off topic posts can be moved elsewhere later?

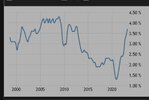

how will that affect inflation

how will that affect inflation