bluekelah

StockFan

- Joined

- 25 March 2013

- Posts

- 246

- Reactions

- 539

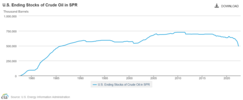

yeah i guess recession has bigger impact on demand. Also the USA has been releasin' oil from their Special Reserves at record pace and USD has been going up and up and up. Possibly even more this winter as Europe falls apart.Yeah it's demand side dropping that has oil dropping. Basically none of the supply issues have been sorted.

| 2020 | 634,967 | 634,967 | 634,967 | 637,826 | 648,326 | 656,023 | 656,140 | 647,530 | 642,186 | 638,556 | 638,085 | 638,086 |

| 2021 | 638,085 | 637,773 | 637,774 | 633,428 | 627,585 | 621,304 | 621,302 | 621,302 | 617,768 | 610,646 | 601,467 | 593,682 |

| 2022 | 588,317 | 578,872 | 566,061 | 547,866 | 523,109 | 493,324 |

Down to 493million barrels now, hasnt been this low since 1985. Look at the chart, supplies starting to fall off a cliff! They are desperately releasing 1million barrels a day to try and keep prices low so that they can bring inflation down a bit and hopefully influence the upcoming elections as high fuel prices at the pump would definitely mean an automatic election loss for Biden. They probably have 1.5 years left before the entire stash is gone. Probably not enough time for them to transition into "green" energy lol...

With the low investment globally into oil industry past 2 years, give it another 1.5years when SPR runs dry/low and all the frackers collapse, i think we could see prices spike to 150 or 200.

In the mean time, Putin has suddenly scheduled a meet with chinas Xi.

over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,524

- Reactions

- 8,091

Another absolute bullseye from peter zeihan. Well worth the 5 minutes to watch.

over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,524

- Reactions

- 8,091

Alright so the queen's just died which I'm sure you're all wondering the relevance to inflation of, so here it is:

Charles fancies himself a modern day lawrence of arabia (and has so for quite some time). There's more than a few images out there of charles, william et al visiting the saudi's to maintain their most specialist of relationships behind their one with the united states and with charles now having finally taken over the reins his years (decades) long lawrence-of-arabia complex may be about to pay the U.K some serious dividends.

Watch this space.

Charles fancies himself a modern day lawrence of arabia (and has so for quite some time). There's more than a few images out there of charles, william et al visiting the saudi's to maintain their most specialist of relationships behind their one with the united states and with charles now having finally taken over the reins his years (decades) long lawrence-of-arabia complex may be about to pay the U.K some serious dividends.

Watch this space.

- Joined

- 14 February 2005

- Posts

- 15,534

- Reactions

- 18,258

The big one in my opinion will be when Putin decides to stop exporting oil to the West.With the low investment globally into oil industry past 2 years, give it another 1.5years when SPR runs dry/low and all the frackers collapse, i think we could see prices spike to 150 or 200.

If that happens then price rises to whatever level shrinks the real economy sufficiently so as to keep planes on the ground, cars in the garage, factories idle and so on.

That might sound far fetched but they've already stopped exporting gas to Europe so it's really just an extension of that. Might seem crazy but I don't think the chance is zero.

over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,524

- Reactions

- 8,091

I'm still betting on the infrastructure reaching such an absolute state of disrepair that they'll have no choice but to stop the flow.The big one in my opinion will be when Putin decides to stop exporting oil to the West.

If that happens then price rises to whatever level shrinks the real economy sufficiently so as to keep planes on the ground, cars in the garage, factories idle and so on.

That might sound far fetched but they've already stopped exporting gas to Europe so it's really just an extension of that. Might seem crazy but I don't think the chance is zero.

There's more at play here than just what the powers that be want/do not want to do.

- Joined

- 8 June 2008

- Posts

- 13,750

- Reactions

- 20,539

Putin warned he will do it if EU puts idiotic caps on.The big one in my opinion will be when Putin decides to stop exporting oil to the West.

If that happens then price rises to whatever level shrinks the real economy sufficiently so as to keep planes on the ground, cars in the garage, factories idle and so on.

That might sound far fetched but they've already stopped exporting gas to Europe so it's really just an extension of that. Might seem crazy but I don't think the chance is zero.

I also suspect that he will if the Ukrainian army + our western special forces starts winning some counterattacks there.

So a matter of time for this to happen.i am an oil and PM bull.

Yesterday was bad for me but today's market already getting better.inflation is here to stay and there are only so much manipulation to be done on oil gold before reality snaps back

- Joined

- 3 May 2019

- Posts

- 6,396

- Reactions

- 10,153

US markets banging.

5% Alerts going off

PLL, SOXL, NRGU and more

Semiconductors are back in flavour

Edit.

Add FEAM and MTC to the list...?

5% Alerts going off

PLL, SOXL, NRGU and more

Semiconductors are back in flavour

Edit.

Add FEAM and MTC to the list...?

bluekelah

StockFan

- Joined

- 25 March 2013

- Posts

- 246

- Reactions

- 539

The big one in my opinion will be when Putin decides to stop exporting oil to the West.

If that happens then price rises to whatever level shrinks the real economy sufficiently so as to keep planes on the ground, cars in the garage, factories idle and so on.

That might sound far fetched but they've already stopped exporting gas to Europe so it's really just an extension of that. Might seem crazy but I don't think the chance is zero.

Many of our generation have not heard of the 1970s inflation. Back then there was an Oil embargo as well. oild prices went up from $3 to nearly $12 and gold went up from $40 an ounce(31.1g) to $160USD.

Xi and Putin are doing an unusally meet next week. They might be talking about doing an oil embargo soon on the west just like the Saudis did. and then when the west is starving for oil and prices go up 3x, Russia will then supply China oil to reexport to the west at skyhigh prices just like what they doing now with NG.

Putin and Xi to meet in Uzbekistan next week, official says

Russian President Vladimir Putin and Chinese President Xi Jinping plan to meet next week in Uzbekistan, a Russian official said Wednesday.

Then they will probably launch their BRICS commodity backed currency.

- Joined

- 3 November 2013

- Posts

- 1,605

- Reactions

- 2,862

That would be the pretext for a larger, global conflict...Many of our generation have not heard of the 1970s inflation. Back then there was an Oil embargo as well. oild prices went up from $3 to nearly $12 and gold went up from $40 an ounce(31.1g) to $160USD.

Xi and Putin are doing an unusally meet next week. They might be talking about doing an oil embargo soon on the west just like the Saudis did. and then when the west is starving for oil and prices go up 3x, Russia will then supply China oil to reexport to the west at skyhigh prices just like what they doing now with NG.

Putin and Xi to meet in Uzbekistan next week, official says

Russian President Vladimir Putin and Chinese President Xi Jinping plan to meet next week in Uzbekistan, a Russian official said Wednesday.www.cnbc.com

Then they will probably launch their BRICS commodity backed currency.

- Joined

- 8 June 2008

- Posts

- 13,750

- Reactions

- 20,539

And that would sort the economy problems, full financial Reset as we are in war: seizure of assets, restriction .all goodThat would be the pretext for a larger, global conflict...

bluekelah

StockFan

- Joined

- 25 March 2013

- Posts

- 246

- Reactions

- 539

And that would sort the economy problems, full financial Reset as we are in war: seizure of assets, restriction .all good

IMHO China wont get involved in any conflict yet unless USA tries to position nukes in Taiwan or South Korea. That why Russia went into Ukraine this year as Romania and Poland have nuke sites now and Ukraine was gonna join NATO and build nuke sites too. China wont itch for a fight with USA until they are at least able to match the Americans in Aircraft carriers and nuclear subs, at the moment they are still ramping their semiconductor industry to produce enough chips/tech needed for modern warfare, which is another reason they may take taiwan(which has the biggest semicon player TSMC) sooner than later if they have BRICs to back them.

By sending billions in weapons and military aid to Ukraine, USA is basically in a cold war type situation with Russia again. But they have no choice, either prevent full invasion of Ukraine or lose their prominence as a world military power and look weak.

But yeah many believe a financial reset is coming. IMHO it will likely be a slow transitory process as power shifts from USA/Europe to Asia (namely China). Europe will need a full reset first at some stage. Or if USA really goes into a financial crisis and the world loses hope in USD and goes back to gold standard.

hyper/high Inflation though is often the first harbinger of a country starting to develop socio-economic problems, and then INEVITABLY you get internal conflict and governmental fall out.

- Joined

- 20 July 2021

- Posts

- 12,714

- Reactions

- 17,661

remember Putin was an accomplished chess player and is a Judo/Jujitsu master ( over 6th degree black belt )Putin warned he will do it if EU puts idiotic caps on.

I also suspect that he will if the Ukrainian army + our western special forces starts winning some counterattacks there.

So a matter of time for this to happen.i am an oil and PM bull.

Yesterday was bad for me but today's market already getting better.inflation is here to stay and there are only so much manipulation to be done on oil gold before reality snaps back

you attacking first isn't always a winning strategy ( against that mentality )

oil prices ( in the West ) and liable to become just as notional as silver prices on the commodity markets

pivotal for oil prices will be production costs ( hardly anybody puts money into development if a profit is unlikely )

- Joined

- 14 February 2005

- Posts

- 15,534

- Reactions

- 18,258

Just my random thoughts but I'm thinking along two separate lines:Xi and Putin are doing an unusally meet next week. They might be talking about doing an oil embargo soon

1. Many of the Russian oil fields are technically difficult and with Western oil companies having left the country probably can't be maintained in operation much longer. Russia is therefore seeking China's assistance in return for selling them the oil at a discount etc. Noting that Russia and China already have deals regarding coal and natural gas done just before the war started so it would be consistent to add oil to that.

2. The US oil releases from the Strategic Petroleum Reserve are scheduled to end in the next few weeks. Perfect time to try and spike the oil price and prompt a further release, thus draining out the reserves as part of a longer term plan to bring about a physical oil crisis.

- Joined

- 8 June 2008

- Posts

- 13,750

- Reactions

- 20,539

So as investors, isn't it a great time to pile on selected oil companies or trades?Just my random thoughts but I'm thinking along two separate lines:

1. Many of the Russian oil fields are technically difficult and with Western oil companies having left the country probably can't be maintained in operation much longer. Russia is therefore seeking China's assistance in return for selling them the oil at a discount etc. Noting that Russia and China already have deals regarding coal and natural gas done just before the war started so it would be consistent to add oil to that.

2. The US oil releases from the Strategic Petroleum Reserve are scheduled to end in the next few weeks. Perfect time to try and spike the oil price and prompt a further release, thus draining out the reserves as part of a longer term plan to bring about a physical oil crisis.

- Joined

- 3 November 2013

- Posts

- 1,605

- Reactions

- 2,862

Oil may also be collapsing due to fears of a recession, as in 2008 and 2020

- Joined

- 8 June 2008

- Posts

- 13,750

- Reactions

- 20,539

True but even with recession on 2020, people are still burning oil and Europe even more in the coming winter..plus end of US stock release..hum not to bad a bet IMHOOil may also be collapsing due to fears of a recession, as in 2008 and 2020

- Joined

- 14 February 2005

- Posts

- 15,534

- Reactions

- 18,258

Cautiously in my view.So as investors, isn't it a great time to pile on selected oil companies or trades?

I’m always wary of investing in something where the underlying reason is politics.

Just needs someone to shoot Putin and things could change real quick.

- Joined

- 8 June 2008

- Posts

- 13,750

- Reactions

- 20,539

Short term only, we have a structural issue due to non/ under investment in fosdil fuel but that would definitely be a time to load up after indeed a good temp plunge.Cautiously in my view.

I’m always wary of investing in something where the underlying reason is politics.

Just needs someone to shoot Putin and things could change real quick.

Will restrain betting the house on this

- Joined

- 20 July 2021

- Posts

- 12,714

- Reactions

- 17,661

So as investors, isn't it a great time to pile on selected oil companies or trades?

not me ( unless TEG drops a fair bit )

am comfortably positioned already ( and have been for a few years .. although not as cosy as coal )

Similar threads

- Replies

- 1

- Views

- 1K

- Replies

- 63

- Views

- 10K

- Replies

- 69

- Views

- 5K