Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,267

- Reactions

- 11,511

Calemb, you lose a little credibility when you blatantly lie about a source of information, and ramp a stock like this here. In the future can you please post a link to any information you might quote from 'other sources'. Thanks, kennascalemb said:Here's something that somebody posted on Topstocks.com.au this morning:

"I have spent the last 2 weeks researching as much as I can about this stock and here's my take on the current and not to distant future situation for IGR.

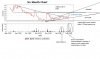

They have built up their resource base to a point that it's now attractive to mine or sell. The news about the extension of time for relocation of the New Celebration processing facility was not negative (as the market generally received it), but strategic and leads me to believe that due to the cost for IGR to process their current resource base being on the high side they are waiting for the gold price to soar up early-mid 2007. In the meantime they will report further discoveries and build their resource base even further. Researching information about the current and future gold price it begins to make more sense...

I have included a link to an article from goldprice.com below. This should help explain where I am going with this:

http://goldprice.org/silver-and-gold-prices/2006/12/silver-price-to-test-24-and-gold-price.html

So my theory is that IGR is currently poised to take advantage of the massive upside in the gold price that awaits them early this year.

Please understand that this only my opinion from the research I have done recently and all speculative.. Thanks for reading"

I agree with this sentiment.....