- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

Re: HVN - Harvey Norman

It was 10 month ago(price that day was $3.39) when in my TA I predicted the target of around $1.8 for Harvey Norman. Today it was trading $1.89

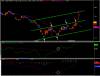

HVN : 21.10.10

The share could not pass the resistance line (white) and recently broke down the support line (Purple) and now testing Fibo 50% . if this can not hold it we should expect the next support level at around 2.96$ (Fibo 61.8 %) Momentum also is near important 0 level and passing down this level could cause more downtrend (Fig 1)

from another point of view share price is testing another support line (yellow). this line can be Neck Line for tilted Head & Shoulders pattern. If the line passed down the target could b around 1.8$ which is the lowest price of HVN in FEB 2009. (Fig 2)

It was 10 month ago(price that day was $3.39) when in my TA I predicted the target of around $1.8 for Harvey Norman. Today it was trading $1.89