- Joined

- 22 June 2005

- Posts

- 277

- Reactions

- 2

Hi Everyone,

This is my first big trade (as in I have put a decent amount of cash on the line - its not more than 2% of my total trading capital though) and the first where I have used "technical" analysis as my basis for making the purchase. My main goal in this trade is to test out the theories I have been reading about in "Trend Trading" by Daryl Guppy to see if I can apply them effectively and to see if they work for me.

The second goal of this trade is to see that, regardless of any flaws it contains, if I can follow my plan to the letter without letting emotion dictate my decisions.

Here is my plan for this trade:

Max Chase: $3.25

(I ended up getting in at this price having put my original bid at $3.23)

Reason for buying:

- In an established uptrend

- Guppy Multiple Moving Average says uptrend is strong and is likely to continue

Stop Loss:

- If price falls below resistance level at $3.18 at end of day, I will cut losses and sell (I found the price $3.18 by using a countback line but didn't include this on the graph)

- I will use a trailing stop loss based on the count back line to lock in any profits if they arise.

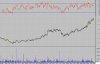

Here are my very amateurish chart analysis for HVN, I have only used two indicators in my analysis, a trend line which I am 100% sure is plotted incorrectly, and the GMMA which I absolutely love, I hope it works for me in the market as well as it does in theory (famous last words).

(famous last words).

My motivation for posting is:

1) I am interested to hear what people think about my primitive analysis

2) I want to get my trades out in the open because this will provide additional emotional stimulus to follow my plan to the letter.

This is my first big trade (as in I have put a decent amount of cash on the line - its not more than 2% of my total trading capital though) and the first where I have used "technical" analysis as my basis for making the purchase. My main goal in this trade is to test out the theories I have been reading about in "Trend Trading" by Daryl Guppy to see if I can apply them effectively and to see if they work for me.

The second goal of this trade is to see that, regardless of any flaws it contains, if I can follow my plan to the letter without letting emotion dictate my decisions.

Here is my plan for this trade:

Max Chase: $3.25

(I ended up getting in at this price having put my original bid at $3.23)

Reason for buying:

- In an established uptrend

- Guppy Multiple Moving Average says uptrend is strong and is likely to continue

Stop Loss:

- If price falls below resistance level at $3.18 at end of day, I will cut losses and sell (I found the price $3.18 by using a countback line but didn't include this on the graph)

- I will use a trailing stop loss based on the count back line to lock in any profits if they arise.

Here are my very amateurish chart analysis for HVN, I have only used two indicators in my analysis, a trend line which I am 100% sure is plotted incorrectly, and the GMMA which I absolutely love, I hope it works for me in the market as well as it does in theory

My motivation for posting is:

1) I am interested to hear what people think about my primitive analysis

2) I want to get my trades out in the open because this will provide additional emotional stimulus to follow my plan to the letter.