- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

I can't wait to see the chart and the lines that explain that one GG.

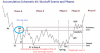

Using the co-ordinates of the peak=>trough and high of todays retracement (7202, 5350, 6037) as inputs to a Fibonacci extension gets you 4582 as the 0.786 extension and 4185 as the 1.0 extension.

A bit hard to see because I had to zoom the chart quite a bit out to show the extensions while the coordinates are all within a short timeframe.

Not that I am necessarily agreeing with the forecast, just showing some lines and numbers. Think of them as potential stopping points of the C move in an A-B-C pattern where the A and B moves have completed.

So not suggesting to go out and buy the airlines right now as GG said, but I think they'll survive after the fallout.

So not suggesting to go out and buy the airlines right now as GG said, but I think they'll survive after the fallout.