- Joined

- 28 May 2020

- Posts

- 7,316

- Reactions

- 14,283

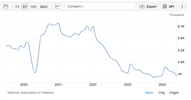

Just to expand on the above, according to Trading Economics June was the fifth month in a row that the number of housing sales has fallen.I resurrected this thread for two reasons.

(1) It is interesting to read what posters (most long gone) had to say on the subject 15 years ago.

(2) It was the closest Thread heading to what i was going to comment on without creating another thread

The USA housing market is a little different to that of OZ in a few areas, but one of the areas that creates a whole new set of problems/advantages is that many of the US cits buy a house with a fixed 30 year mortgage.

So If you bought a house in 2020 when there were effectively negative rates from the Fed Reserve, you could lock in a 30 year mortgage at 3%.

From Zero Hedge

Once again it shows that those unfortunate "unintended consequences" will pop up and ruin the best laid plans of mice and men.

Mick

In fact, since the perturbations of the COVID crisis, housing sales have been on a steady decline, and exacerbated by the interest rate rises.

Along with high interest rates, the average national price over that time has risen to $427,000 , so its not exactly surprising that there is buyer resistance.

Another stat highlighting the pressure is that there are now more NEW single family homes for sale than at any time since early 2008.

Not these are different from sales of all available houses,, but shows the devlopers are carrying a lot of stock.

If one looks at the historical sales of new single family houses, one can see that the sales plunged from 2005 through 2009, which suggests there was some lag between building new homes and sales.

It might suggest that building of homes will likely fall , its depth will depend on for how long buyers resit paying high proices at higher interest rates.

Mick