- Joined

- 25 February 2007

- Posts

- 838

- Reactions

- 1

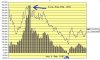

Goodbye Housing Bubble

Boom Bust - UK housing bubble set to burst

www.ablemesh.co.uk/thoughtsboombust.html

Some of the music sucks, but anyway, you'll get the message...

Boom Bust - UK housing bubble set to burst

www.ablemesh.co.uk/thoughtsboombust.html

Some of the music sucks, but anyway, you'll get the message...