- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

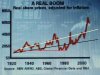

Look at it any way you will .... Doctor/Professor robots is technically correct when he states the name of this thread "House prices to keep rising for years." Graphic evidence in the form of a graph from the most trusted of sources. The Guvmnt. We can theorise about sustainablility and macro and micro economic factors and "push pull" fiscal policies with RBA's interetst rate rises and KRudds stimulus packages all we like. Bottom line is that the residential RE is rising. How long will it last? It keeps on going, man.

Or maybe just keeping up with money supply inflation while making people think they are making real money? Take RMBS - $10B just for the direct government 'subsidy' to the big boy banks, and another $8B for the juniors that missed out?

PRESSURE is mounting on Treasurer Wayne Swan to start winding back the government guarantee that has underwritten debt raisings for banks, with the Reserve Bank board suggesting Australia has started to lag the world on ending the program.

------

Government-guaranteed bonds have accounted for the majority of corporate bond issues in 2009, with some $56 billion issued in the domestic market so far this year.

Then pile on all the other 'schemes', grants, tax subsidies, negative gearing etc etc and you have a subsidised free market capitalist system which starts to look a lot like socialism/communism, except that (Chinese) communism now looks like old capitalism???

The bottom line is that there is no free lunch - someone will be left holding the baby, the only unknown is the timing.......flip away