You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

HALO Research Portal

- Thread starter samso

- Start date

- Joined

- 16 October 2018

- Posts

- 1

- Reactions

- 0

Hi there,

I am trying to find out the same thing

I have had a brief look at the program a run through with all the bells and whistles with a sales rep they are letting me have a play for a week , but I cant find any reviews on halo or the company other than a couple from 2006

Anyone else have anything?????

I am trying to find out the same thing

I have had a brief look at the program a run through with all the bells and whistles with a sales rep they are letting me have a play for a week , but I cant find any reviews on halo or the company other than a couple from 2006

Anyone else have anything?????

Hello did you find any reviews on Halo and the company?Hi there,

I am trying to find out the same thing

I have had a brief look at the program a run through with all the bells and whistles with a sales rep they are letting me have a play for a week , but I cant find any reviews on halo or the company other than a couple from 2006

Anyone else have anything?????

I was just wondering the same thing. Their webinars seem like, "lets get down to business".

Years ago, I was a buy and forget 'invester'. These days, while you may receive dividends, it can be at the expense of capital using this method. Since I have been short term trading, and pretty well ignoring dividends(if one arrives, a bonus) I have been doing much better. I have been a Market Matters client for the last three years.

Years ago, I was a buy and forget 'invester'. These days, while you may receive dividends, it can be at the expense of capital using this method. Since I have been short term trading, and pretty well ignoring dividends(if one arrives, a bonus) I have been doing much better. I have been a Market Matters client for the last three years.

- Joined

- 3 June 2019

- Posts

- 2

- Reactions

- 1

I've been using HALO for a couple of months, I also met some of the team at the Australian Shareholders Association last month.

I guess the main complaint for me is that it was a bit complicated at first so had to put the time in watching training videos and calling the help desk, apart from that its been pretty good. It has info on pretty much every ASX company and has heaps of scans (some with some pretty funny names like Fakey Shaky) and scans that show you anything from high dividend stocks with good fundamentals to what is it cheap and what's expensive and a bunch other handy information like broker consensus, I mainly use the portfolio analysis tool though.

It is pretty information intensive, it provides a lot of company information so I'm still finding my way around the program. Has anyone else had any experience with HALO or the same problem? There really doesn't seem to be much information from other users reviews on it or anywhere, or anywhere that I can find comparisons to other similar fundamental analysis based platforms.

From my little knowledge of other platforms it seems quite a bit better because the indicators are fundamental analysis, I think pure technical analysis is a bit hit and miss. The only other platform that seems similar is Stock Doctor which looks pretty outdated and ironically can be a bit short on information at times.

The Australian Stock Report representative (I don't know if I'm supposed to say his name) said that they're also launching US data soon which I'm looking forward to.

The ASR representative said that I should also look at their trading platform called ********. The brokerage seems cheap at $15 and it gives direct access to ASX and international shares, including the Canadian Exchange.

I can't find any reviews on ******** anywhere either!

I guess the main complaint for me is that it was a bit complicated at first so had to put the time in watching training videos and calling the help desk, apart from that its been pretty good. It has info on pretty much every ASX company and has heaps of scans (some with some pretty funny names like Fakey Shaky) and scans that show you anything from high dividend stocks with good fundamentals to what is it cheap and what's expensive and a bunch other handy information like broker consensus, I mainly use the portfolio analysis tool though.

It is pretty information intensive, it provides a lot of company information so I'm still finding my way around the program. Has anyone else had any experience with HALO or the same problem? There really doesn't seem to be much information from other users reviews on it or anywhere, or anywhere that I can find comparisons to other similar fundamental analysis based platforms.

From my little knowledge of other platforms it seems quite a bit better because the indicators are fundamental analysis, I think pure technical analysis is a bit hit and miss. The only other platform that seems similar is Stock Doctor which looks pretty outdated and ironically can be a bit short on information at times.

The Australian Stock Report representative (I don't know if I'm supposed to say his name) said that they're also launching US data soon which I'm looking forward to.

The ASR representative said that I should also look at their trading platform called ********. The brokerage seems cheap at $15 and it gives direct access to ASX and international shares, including the Canadian Exchange.

I can't find any reviews on ******** anywhere either!

See the reviews on https://www. productreview.com.au/listings/australian-stock-report and beware, the quality of the software, for the cost, is pretty poor imho, found better options elsewhere like Lincoln and Montgomery

- Joined

- 27 March 2020

- Posts

- 1

- Reactions

- 0

Hi I am considering looking at Halo( part of Australian Stock Report ) but have not found too much data on it .I have asked for a trial l but have told them up front I will return it after 30 days so I am not paying anything as I have seen a lot of people have had trouble getting money back .I saw a seminar and they only show the successes and make it appear that every case is a winner

Hi I am considering looking at Halo( part of Australian Stock Report ) but have not found too much data on it .I have asked for a trial l but have told them up front I will return it after 30 days so I am not paying anything as I have seen a lot of people have had trouble getting money back .I saw a seminar and they only show the successes and make it appear that every case is a winner

- Joined

- 2 May 2007

- Posts

- 4,688

- Reactions

- 2,901

yesIs this connected WITH ASR

- Joined

- 2 May 2007

- Posts

- 4,688

- Reactions

- 2,901

Hello followers of this thread.

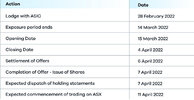

HALO technology is coming with an IPO on 8 March and aiming to list on around 4 April (Too ambitious or confident with no underwriter)

Would you share your observation and thoughts on this IPO?

My concern is the revenue source is not robust and purpose of the IPO includes repayment of debt and facilitate sell down . Others are just less significant

$10 M expected income and $40 M IPO??

Would it be a dodgy one like NLX as the stock price would be $1.20 for a little known company

HALO technology is coming with an IPO on 8 March and aiming to list on around 4 April (Too ambitious or confident with no underwriter)

Would you share your observation and thoughts on this IPO?

My concern is the revenue source is not robust and purpose of the IPO includes repayment of debt and facilitate sell down . Others are just less significant

$10 M expected income and $40 M IPO??

Would it be a dodgy one like NLX as the stock price would be $1.20 for a little known company

Attachments

- Joined

- 2 May 2007

- Posts

- 4,688

- Reactions

- 2,901

HALO exposure has been extended by another seven days under ASX direction.

What our fellow ASF members who are following HALO and who can give some guidance on the implication of extending the exposure period mean ? @peter2 @tech/a @Ann @debtfree @Sean K @frugal.rock @Garpal Gumnut @Dona Ferentes @Skate @sptrawler @barney @Joe Blow @finicky

extract of email received because I registered my interest !

What our fellow ASF members who are following HALO and who can give some guidance on the implication of extending the exposure period mean ? @peter2 @tech/a @Ann @debtfree @Sean K @frugal.rock @Garpal Gumnut @Dona Ferentes @Skate @sptrawler @barney @Joe Blow @finicky

extract of email received because I registered my interest !

| This email is to inform you that the exposure period for the IPO has been extended by an additional 7 days and that the IPO open date has been rescheduled for Tuesday 15 March 2022. |

What does this mean for the IPO?When a prospectus is lodged with Australian Securities & Investments Commission (ASIC), there is a subsequent ‘exposure period’ of seven days in which the prospectus becomes available for public review and comment.ASIC have exercised their right to extend the exposure period for the HALO Technologies Holdings Limited IPO by an additional 7 days to allow for more time to review the prospectus in detail. As a result, the IPO open date and ASX listing date have been rescheduled to a later date. Please see below for more information. |

When will the IPO proceed?Please see the table below for the updated expected timings for the HALO Technologies Holdings Limited IPO. |

| Please note: These dates are subject to change, however, we expect there to be no further delay. We apologise for any inconvenience and are available to answer any questions by phone or email. |

- Joined

- 3 May 2019

- Posts

- 6,182

- Reactions

- 9,669

That's like a call to arms Mr Miner.

My guess only, no knowledge of Halo...

Extended perhaps due to lack of interest (not enough participants), for whatever reason,

potentially the product, or, the geopolitical situation, or both.

I'm not an IPO person though.

@Dona Ferentes seems to be all over them? (IPO's in general, not stating anything about Halo)

My guess only, no knowledge of Halo...

Extended perhaps due to lack of interest (not enough participants), for whatever reason,

potentially the product, or, the geopolitical situation, or both.

I'm not an IPO person though.

@Dona Ferentes seems to be all over them? (IPO's in general, not stating anything about Halo)

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,400

- Reactions

- 6,317

Sorry Miner.

As a price action trader, I don't have any interest until it's trading.

As a price action trader, I don't have any interest until it's trading.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,344

- Reactions

- 9,449

Give The Healthy Mummy ( THM ) a Halo and this is what happens.HALO exposure has been extended by another seven days under ASX direction.

What our fellow ASF members who are following HALO and who can give some guidance on the implication of extending the exposure period mean ? @peter2 @tech/a @Ann @debtfree @Sean K @frugal.rock @Garpal Gumnut @Dona Ferentes @Skate @sptrawler @barney @Joe Blow @finicky

extract of email received because I registered my interest !

This email is to inform you that the exposure period for the IPO has been extended by an additional 7 days and that the IPO open date has been rescheduled for Tuesday 15 March 2022.

What does this mean for the IPO?

When a prospectus is lodged with Australian Securities & Investments Commission (ASIC), there is a subsequent ‘exposure period’ of seven days in which the prospectus becomes available for public review and comment.

ASIC have exercised their right to extend the exposure period for the HALO Technologies Holdings Limited IPO by an additional 7 days to allow for more time to review the prospectus in detail.

As a result, the IPO open date and ASX listing date have been rescheduled to a later date. Please see below for more information.

When will the IPO proceed?

Please see the table below for the updated expected timings for the HALO Technologies Holdings Limited IPO.

Please note: These dates are subject to change, however, we expect there to be no further delay. We apologise for any inconvenience and are available to answer any questions by phone or email.

It is all online with a search particularly the AFR.

I would agree with @frugal.rock .

Some investors getting out, percentage holdings of significant investors has diluted the company and it is now running to market with a capital raise at an obscene discount.

I have been married to four very healthy mummies and still wear the scars so it is not for me.

I'll just put the bandages on my Halo.

gg

- Joined

- 2 May 2007

- Posts

- 4,688

- Reactions

- 2,901

Thanks Tech. All good . I just reached out few of the active fellows just in case they can throw light.Sorry Miner.

As a price action trader, I don't have any interest until it's trading.

- Joined

- 2 May 2007

- Posts

- 4,688

- Reactions

- 2,901

Thanks GG for sharing your pain with mummies. I am sorry and agree.Give The Healthy Mummy ( THM ) a Halo and this is what happens.

It is all online with a search particularly the AFR.

I would agree with @frugal.rock .

Some investors getting out, percentage holdings of significant investors has diluted the company and it is now running to market with a capital raise at an obscene discount.

I have been married to four very healthy mummies and still wear the scars so it is not for me.

I'll just put the bandages on my Halo.

gg

Now Shane Warne has given enough lessons to learn with too many mummies so take care and stick to one mummy (like I have for 36 years)

- Joined

- 2 May 2007

- Posts

- 4,688

- Reactions

- 2,901

Yes @frugal.rock I have the same fear and thought to reach out to you folks as I am often wrong than right on financial sideThat's like a call to arms Mr Miner.

My guess only, no knowledge of Halo...

Extended perhaps due to lack of interest (not enough participants), for whatever reason,

potentially the product, or, the geopolitical situation, or both.

I'm not an IPO person though.

@Dona Ferentes seems to be all over them? (IPO's in general, not stating anything about Halo)

Dona Ferentes

A little bit OC⚡DC

- Joined

- 11 January 2016

- Posts

- 15,080

- Reactions

- 20,447

A company coming to market needs to satisfy ASX listing requirements. Apart from the process, there is a minimum number of investors needed. I think it is 400 different shareholders. Locked in.That's like a call to arms Mr Miner.

My guess only, no knowledge of Halo...

Extended perhaps due to lack of interest (not enough participants), for whatever reason,

potentially the product, or, the geopolitical situation, or both.

| Listing date | 04 April 2022 # |

| Company contact details | https://www.halo-technologies.com/ Ph: 02 8356 9356 |

| Principal Activities | Equities research and trade execution platform |

| GICS industry group | TBA |

| Issue Price | AUD 1.20 |

| Issue Type | Ordinary Fully Paid Shares |

| Security code | HAL |

| Capital to be Raised | $40,000,000 |

| Expected offer close date | 28 March 2022 |

| Underwriter | Not underwritten. Lodge Corporate Pty Ltd (Lead Manager). |

Similar threads

- Replies

- 1

- Views

- 707