7.5% Dividend Yield.

No brainer.

Capital Gains will follow a high Dividend Yield.

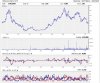

Just trying to follow the logic here ... would you not have made a lot more money after bailing out at the first sign of a relentless sell of when the share price was $1 higher recently, rather than trying to top-em-up cause they're so cheap now and wait for a 7.5% dividend yield??

Learning as I go.

Rob