Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,687

- Reactions

- 12,354

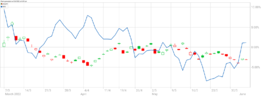

Can I suggest this magnificent maiden just listed on the NYSE

In only 2 days she is in the TOP TEN Energy companies in all of the NYSE

View attachment 142566

As you can see

She has hit Blue sky on only her second day

View attachment 142567

Who Needs the Rest?

My Apologies

I did not notice that you were all searching for "Fools Gold"

Woodside is gold! lol