- Joined

- 20 July 2021

- Posts

- 11,723

- Reactions

- 16,345

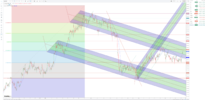

am wondering if this is actually a move to $US in an attempt to deleverage debt , of course it could be a suppression to start a stampede into US Treasuries as well

good luck

good luck