- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

not a smidgeon of a rotation, let's not stand in the way

news that fits the trend

https://www.reuters.com/article/uk-...tent&utm_medium=trueAnthem&utm_source=twitter

news that fits the trend

https://www.reuters.com/article/uk-...tent&utm_medium=trueAnthem&utm_source=twitter

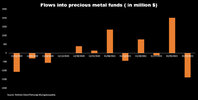

iShares Silver Trust saw outflows of $919.1 million, while SPDR Gold Shares had net sales of $621 million in the last week.