Forex help

- Thread starter andrew100

- Start date

Here's another simple system suited to trading Forex and just about any other market......the Triple Screen System outlined by Alex Elder in his book 'Trading For A Living'.

Of the various entry setups I use to find Forex trades, the Triple Screen setup is probably the one that shows up most often. The reason it gives so many signals is simply that it enters from temporary retracements within established trends. And retracements during trends are common....it's a rare trend that goes from start to finish without the price action moving temporarily against the trend at least a couple of times.

The three 'screens' or filters in the TS system are....

1. First screen......Identify the trend on the weekly chart.

(Elder gives a number of options for identifying the weekly trend, the simplest of them being the slope of a 13 week Exponential moving average.)

2. Second screen....Go to the daily charts to find retracements against the weekly trend.

(Elder uses a momentum based indicator for this. He mentions a couple of them, but the one I personally use is CCI (Commodity Channel Index) on a setting of 3. This common indicator is available in all decent charting software. When there's a retracement during an uptrend, CCI gives a buy signal by falling below zero. When there's a rally during a downtrend, CCI gives a signal to go short when it rises above zero.)

3. Third screen...Price action must confirm the indicator signal.

(In other words, the uptrend must resume. You don't go long just because the indicator is giving a buy signal....sometimes price will keep falling irrespective of the buy signal. The trick is to wait for the price action to confirm the indicator signal, then go long. This means you don't buy unless price action starts rising. However, you can anticipate the rising price action by putting a buy order above the second last candle, once the CCI drops below zero. This will put you into the trade automatically if the trend resumes, as you expect it to do.

Or if the price decline continues, you can lower your buy order each day to just above the second last candle.

The stop loss is placed just below the most recent low.

I've made a few minor changes to the Triple Screen system. Rather than identify the trend by looking at the slope of a 13 EMA on the weekly chart, I decided to use the slope of a 65 day EMA on a daily chart. (13 weeks X 5 trading days/week = 65 days) I found that 13 week EMA and 65 day EMA closely duplicate each other.....both will be rising, falling or flat at more or less the same time.

Then through trial and error I shortened the 65 day EMA to 50 EMA to make it more responsive to trend changes in Forex.

I added 7, 14 & 21 EMA's, perhaps unnecessarily, but I like them as a handy quick reference guide to show when a market has started trending strongly.

The CCI is not mentioned by Elder, but it's my preferred indicator after having conducted extensive testing on a number of indicators.

The moving averages and the indicators are not essential. You can simply eyeball a bare bar or candle chart to see when there's a good trend underway, wait for a retracement against the trend, then put your entry order on the trendward side of the market.

But my personal choice is to use a few moving averages and an indicator....I find they make my analysis quicker and easier.

For short entries into downtrends, the above rules are simply reversed.

The Triple Screen system trades with the trend, enters at strategic times during the trend, lets profits run and cuts losses short. Its objective is potentially big profits from the winners, while ensuring that losses are kept small on the trades that don't work out. It achieves these objectives very well.

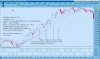

A picture is worth a thousand words....the chart below shows how the Triple Screen system gave a timely entry into the sort of trade that traders dream about.

Of the various entry setups I use to find Forex trades, the Triple Screen setup is probably the one that shows up most often. The reason it gives so many signals is simply that it enters from temporary retracements within established trends. And retracements during trends are common....it's a rare trend that goes from start to finish without the price action moving temporarily against the trend at least a couple of times.

The three 'screens' or filters in the TS system are....

1. First screen......Identify the trend on the weekly chart.

(Elder gives a number of options for identifying the weekly trend, the simplest of them being the slope of a 13 week Exponential moving average.)

2. Second screen....Go to the daily charts to find retracements against the weekly trend.

(Elder uses a momentum based indicator for this. He mentions a couple of them, but the one I personally use is CCI (Commodity Channel Index) on a setting of 3. This common indicator is available in all decent charting software. When there's a retracement during an uptrend, CCI gives a buy signal by falling below zero. When there's a rally during a downtrend, CCI gives a signal to go short when it rises above zero.)

3. Third screen...Price action must confirm the indicator signal.

(In other words, the uptrend must resume. You don't go long just because the indicator is giving a buy signal....sometimes price will keep falling irrespective of the buy signal. The trick is to wait for the price action to confirm the indicator signal, then go long. This means you don't buy unless price action starts rising. However, you can anticipate the rising price action by putting a buy order above the second last candle, once the CCI drops below zero. This will put you into the trade automatically if the trend resumes, as you expect it to do.

Or if the price decline continues, you can lower your buy order each day to just above the second last candle.

The stop loss is placed just below the most recent low.

I've made a few minor changes to the Triple Screen system. Rather than identify the trend by looking at the slope of a 13 EMA on the weekly chart, I decided to use the slope of a 65 day EMA on a daily chart. (13 weeks X 5 trading days/week = 65 days) I found that 13 week EMA and 65 day EMA closely duplicate each other.....both will be rising, falling or flat at more or less the same time.

Then through trial and error I shortened the 65 day EMA to 50 EMA to make it more responsive to trend changes in Forex.

I added 7, 14 & 21 EMA's, perhaps unnecessarily, but I like them as a handy quick reference guide to show when a market has started trending strongly.

The CCI is not mentioned by Elder, but it's my preferred indicator after having conducted extensive testing on a number of indicators.

The moving averages and the indicators are not essential. You can simply eyeball a bare bar or candle chart to see when there's a good trend underway, wait for a retracement against the trend, then put your entry order on the trendward side of the market.

But my personal choice is to use a few moving averages and an indicator....I find they make my analysis quicker and easier.

For short entries into downtrends, the above rules are simply reversed.

The Triple Screen system trades with the trend, enters at strategic times during the trend, lets profits run and cuts losses short. Its objective is potentially big profits from the winners, while ensuring that losses are kept small on the trades that don't work out. It achieves these objectives very well.

A picture is worth a thousand words....the chart below shows how the Triple Screen system gave a timely entry into the sort of trade that traders dream about.

Attachments

- Joined

- 26 August 2008

- Posts

- 3

- Reactions

- 0

Definitely going to try this one out on the demo bunyip

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,454

- Reactions

- 6,521

A picture is worth a thousand words....the chart below shows how the Triple Screen system gave a timely entry into the sort of trade that traders dream about.

Selective bias.

There are countless examples of failure of analysis.(Triple screen).

CCI is only conforming to price action in hindsite.

Many "signals" beyond those shown in your chart---why stop buying?

In walk forward analysis which DONT you take?

Its far too slow in my opinion.

Selective bias.

There are countless examples of failure of analysis.(Triple screen).

CCI is only conforming to price action in hindsite.

Many "signals" beyond those shown in your chart---why stop buying?

In walk forward analysis which DONT you take?

Its far too slow in my opinion.

Selective bias.

Meaning, I presume, that I've selected a perfect example of this system. Yes, that's exactly what I've done...the purpose being to show the workings of the system. Not all of them work out this well. Some of them fail.

There are countless examples of failure of analysis.(Triple screen).

Sure there are examples of where these trades don't work out, just as there is in every other trading strategy. I've openly stated that I win only about half of my trades. No problem...strictly control the losses, let the winners run for the duration of the trend. Far bigger average winner than average loser.

CCI is only conforming to price action in hindsite.

CCI responds to price action. How quickly it responds depends on what setting you use. On a setting of 3 it's quite responsive and it does a pretty good job of alerting you when a stock or market starts retracing against the trend. Not that you need it - dispense with the CCI if you like and just eyeball the chart to see for yourself when the retracements are happening.

CCI and other indicators come into their own when you want to find countertrend retracements in a watchlist of hundreds of stocks. Any decent charting software can scan for CCI crossing above or below the zero line.

Many "signals" beyond those shown in your chart---why stop buying?

Why indeed....did I say I stop buying? I've shown other buy signals that turned up later in the trend.....good places to pyramid the position. In an earlier post I referred to pyramiding as 'one of the most profit-enhancing of all trading strategies'.

In walk forward analysis which DONT you take?

I assess each trade on its merits. There are subtle visual clues as to whether a retracement is coming to an end, or is likely to continue further. I don't propose to go into details here.

Its far too slow in my opinion.

Then don't use it. Maybe your sense of urgency is greater than mine. I'm not in any rip tearing hurry to get in when I see a new trend get underway. I don't feel any great sense of urgency to board the train. I'd rather sit back and wait for the trades to come to me. I don't care if the trend runs a while before it pauses or pulls back to give me one of my entry setups.

Triple Screen is just one of the many methodologies for entering trends after temporary retracements against the trend. Elder didn't invent the strategy of trading from retracements....it had been used by many traders for decades before he came on the scene. All he did was add specific rules to a proven strategy, give it a name, then market it via his books and trading workshops.

My strategy for years has been to enter trends after countertrend retracements, and also after consolidation patterns during the trend. New trends usually pause or pull back not long after they begin, giving you a timely entry point. Some of my entries are from Triple Screen, sometimes from candlestick patterns, sometimes from rectangles and triangles, sometimes something else.

You can do very well with a strategy that enables you to take hefty bites out of trends. That's my objective on every trade.

It's been working for me for ten years so far.

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Bunyip, how do you trail the stop?

Cheers,

CanOz

Cheers,

CanOz

Ah...a very good question and one that I've been expecting, since I've said little or nothing so far about exits or how to trail the stop.Bunyip, how do you trail the stop?

Cheers,

CanOz

This chart tells the story.

Attachments

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Thanks Bunyip, pretty much explains it. I might have to try this me thinks, what with no trade on in equities at the moment.

Cheers,

CanOz

Cheers,

CanOz

Thanks Bunyip, pretty much explains it. I might have to try this me thinks, what with no trade on in equities at the moment.

Cheers,

CanOz

Yeh, give it a whirl and see how you go. If you can trade equities you should be also able to trade the Forex markets....they're smoother trending, rarely gap, and rarely give you any slippage on your entries and exits. And they tend to trend more often than not.

If I can offer a couple of snippets of advice......

* Trade very small to begin with, no matter how much money is in your trading account. 1 mini contract would be perfect to dip your toe in the water.

* Make sure your trading account is sufficiently funded. If putting your stop in the correct technical position causes you to risk more than 2% of your trading account, your account is too small. 1% risk is even better. If you risk 6 or 7 or 10% of your account on each trade, three or four losing trades in a row will severely dent both your trading account and your confidence, possibly causing you to abandon what is a profitable system.

Compare this to risking just 1% on each trade. Four or five consecutive losing trades won't have much effect on your trading capital, and if your trading capital stays intact then your confidence will stay intact as well. With your confidence intact, you'll ride out a few losing trades no worries and stick with your system until the good trades arrive.

* Don't discount the importance of a timely entry. The idea that entries are not particularly important is a complete fallacy. Once a new trend gets underway, there's no urgency to get in. It doesn't matter if the trend initially runs a few hundred points and you're missing out on the profit opportunity.

Patience is the name of the game....sit back and wait for the trades to come to you, wait for the right setup to appear.

The market has to comply with your wishes, not the other way around. How do you make the market comply with your wishes? You don't....you just refuse to trade it unless it does comply. In other words....no setup, no trade.

You greatly increase your odds of success if you wait for a trend, then enter from one of those patterns which signal that a momentum surge is imminent. The charts I've posted on this thread show those patterns.

You may have heard of Linda Bradford-Raschke...she's one of the traders featured in Jack Schwager's 'Market Wizards' books.

Linda was asked in an interview..."How important is market timing in your analysis?"

Her reply was.... "Very important. It helps determine how much you want to risk and it helps determine the degree of follow through.

If your timing is such that you are hopping aboard right when there is an increase in momentum, then you have greatly increased the probability of follow through in your direction."

* Don't decide when to get out of a trade....let your stop make that decision for you. Trail the stop according to your rules - let it take you out of the trade when the time comes. This is the only chance you have of riding those really big trades for the duration of the trend.

- Joined

- 26 August 2008

- Posts

- 3

- Reactions

- 0

Like the advice there. How would you advise we calculate how large our trailing stops should be? I know some like to use the preceeding day's high/low depending on the trend and other's the base it off the ATR of the currency that they are trading. I guess it's just a matter of keeping it close to the fire but not too close as to be stopped out. Would be very interested in your thoughts regading the matter.

Like the advice there. How would you advise we calculate how large our trailing stops should be? I know some like to use the preceeding day's high/low depending on the trend and other's the base it off the ATR of the currency that they are trading. I guess it's just a matter of keeping it close to the fire but not too close as to be stopped out. Would be very interested in your thoughts regading the matter.

I don't have hard and fast rules with regard to calculating how far away the stop should be. As a general rule I use a figure of 20 points above each lower peak (in a short trade) and 20 points under each higher trough (for a long trade). But I'll vary that figure at my discretion, e.g. if the trend is really stepping along with big range days then it's reasonable to give it a bit more room by keeping your trailing stop out a bit wider.

I think the important thing with trailing stops is to trail them at technical levels, i.e. at swing points in the market. Swing points are important during trends because they show where market sentiment changed, and the main trend has resumed. In theory, once the trend resumes, the market shouldn't come back to these swing points again during the trend. So (again in theory) swing points are good guidelines as to where to trail the stop.

I wouldn't be willing to claim I've found the perfect trailing stop mechanism, but what I use seems to work ok most times.

I'm still learning in this game, just like we all are. After 4 years or so in the currency markets I'm still finding out new things.

- Joined

- 26 August 2008

- Posts

- 3

- Reactions

- 0

Thanks Bunyip. Can't help but smile when I hear experienced traders like yourself say that they are still learning and I look at where I'm at.  : Guess that's part of the fun of trading.

: Guess that's part of the fun of trading.

This information in this Forex chart will be well known to established traders, but may be useful to beginners.

It shows how old support levels, once broken, tend to become new resistance levels. This is known as the 'change of polarity' principle, and I first became aware of it after seeing it in one of Steve Nison's book on Japanese candlestick charts.

Also, this chart shows how a confluence of technical signals can add to the credibility of a trade setup.

This chart is from 1977...31 years ago. Popular opinion says the markets are changing all the time, and you have to adapt to the changes by constantly updating and changing your trading strategies.

My research debunks this theory......the very same trends, patterns, support and resistance levels, retracements, and every other technical feature you can think of, can be seen in every chart of every market in every timeframe in every year going right back to the 1920's. I know this because I've studied charts, thousands of them, across a wide variety of markets going back a long, long way, and all of them showed the very same features and trade setups that we see in today's charts.

And so they should......price movements on a chart are caused by human nature, and human nature doesn't change.

I'm trading from the same strategies I've always used.....they work as well today as they ever did.

It shows how old support levels, once broken, tend to become new resistance levels. This is known as the 'change of polarity' principle, and I first became aware of it after seeing it in one of Steve Nison's book on Japanese candlestick charts.

Also, this chart shows how a confluence of technical signals can add to the credibility of a trade setup.

This chart is from 1977...31 years ago. Popular opinion says the markets are changing all the time, and you have to adapt to the changes by constantly updating and changing your trading strategies.

My research debunks this theory......the very same trends, patterns, support and resistance levels, retracements, and every other technical feature you can think of, can be seen in every chart of every market in every timeframe in every year going right back to the 1920's. I know this because I've studied charts, thousands of them, across a wide variety of markets going back a long, long way, and all of them showed the very same features and trade setups that we see in today's charts.

And so they should......price movements on a chart are caused by human nature, and human nature doesn't change.

I'm trading from the same strategies I've always used.....they work as well today as they ever did.

Attachments

Some amazing trends are currently in progress in a number of Forex pairs.

This chart shows an unusual mid week gap in the big-trending EURUSD.

Usually the gaps, which are rare, occur between Fridays close and Mondays open and tend to be in the direction of the trend, which works very much in favour of trend-riding traders.

This chart shows an unusual mid week gap in the big-trending EURUSD.

Usually the gaps, which are rare, occur between Fridays close and Mondays open and tend to be in the direction of the trend, which works very much in favour of trend-riding traders.

Attachments

BentRod

ZZZZzzzzZZZZzzzzzzzz

- Joined

- 16 December 2005

- Posts

- 694

- Reactions

- 0

Which chart is that Bunyip?

Euro Daily?

I can't find any gap.

Euro Daily?

I can't find any gap.

Which chart is that Bunyip?

Euro Daily?

I can't find any gap.

EURUSD daily.

Looks like my data is at fault. I just checked out another data source and it shows no gap.

I'm waiting for a call back from my data supplier.....they're about to get their ear chewed!

BentRod

ZZZZzzzzZZZZzzzzzzzz

- Joined

- 16 December 2005

- Posts

- 694

- Reactions

- 0

ah.

No wonder I was confused.

No wonder I was confused.

Similar threads

- Replies

- 11

- Views

- 3K

- Replies

- 4

- Views

- 1K

- Replies

- 22

- Views

- 2K