Most Forex traders are intraday traders working from live charts. My opinion is that end of day charts are far easier and more profitable.

* It takes no more than 15 minutes a day to analyse ten or so currency pairs from daily charts.

* Daily charts give you the opportunity of cutting your losses short but letting your winners run to figures that are many times your initial risk. You might use an initial stop of 100 pips from entry, and get a profit of 300 to 1200 pips or more.......many times your initial risk. It's very hard to do this with intraday trading.

* Trading from daily charts allows you to utilise one of the most profit-enhancing of all trading strategies - pyramiding. You can add to your position as the trend runs in your favour. Or once your trade has run far enough to allow you to move your stop to break even, you can enter trades in other pairs as the opportunity arises.

Intraday trading is much less conductive to pyramiding.

* Trading from daily charts eliminates the need to sit in front of your computer at night, watching the screen. Our night is the European and American business day when most of the currency trading action takes place. Even if you can't look at your daily charts until you come home from work, that's usually OK.....there's usually not much movement during our day anyway.

*Trading from daily charts allows you to easily monitor 10 or so currency pairs. More pairs means more trading opportunities. Intraday, you just don't have the time to monitor that many pairs.

Australian traders are naturally drawn to AUDUSD and AUDJPY. These are OK, but there are other pairs with smoother trends and bigger runs.

The ones I follow are...

AUDUSD

USDCAD

USDJPY

USDCHF

EURUSD

GBPUSD

EURJPY

AUDJPY

AUDEUR

NZDUSD (only recently added this one after noticing that it's put in some good trends and it has a reasonably tight spread, haven't actually traded it yet)

When choosing which pairs to trade, take into account firstly, their 'trendiness' (how well they trend), and secondly, their spread. I won't trade anything with greater than a 5 pip spread between bid and ask. Remember that spread is commission in disguise. The higher the commission, the more it chews into your trading profits.

If you're going to trade from daily charts, I'd suggest that 10 grand is a comfortable amount to have in your trading account. Using a stop of around 100 pips from entry, and trading one mini contract, your potential $100 loss represents just 1% of your trading account, which is ideal. You could get away with a $5000 account, in which case you'd be risking 2% of your account. This is still acceptable, but on some trades you might want to use more than 100 pip stops, which means you'd be violating the 2% rule.

If you trade from end of day charts, look also at 2 day charts and 3 day charts.

Sometimes a valid trade setup will show up on one time frame but not on the others.

Following three different time frames gives you more trade setups to choose from.

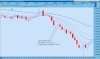

Put a longer term moving average on your daily charts, such as 50 EMA, and only trade in the same direction as the slope of that moving average. This is in line with Elder's Triple Screen system that says look at a 13 week Exponential Moving Average (EMA) on the weekly chart to identify the longer term trend direction, then go to the daily chats and find trade setups that signal entries in the direction of the weekly trend. 13 week EMA converts to 65 day EMA (13 weeks multiplied by 5 trading day per week).

I've found that the 65 day EMA is slightly too long for daily Forex charts....50 EMA is better.

As for the news - I completely ignore it when trading from daily charts. I'm a technical analyst working from the premise that the charts give me the information I need to trade profitably. Seems to be working well enough so far.

* It takes no more than 15 minutes a day to analyse ten or so currency pairs from daily charts.

* Daily charts give you the opportunity of cutting your losses short but letting your winners run to figures that are many times your initial risk. You might use an initial stop of 100 pips from entry, and get a profit of 300 to 1200 pips or more.......many times your initial risk. It's very hard to do this with intraday trading.

* Trading from daily charts allows you to utilise one of the most profit-enhancing of all trading strategies - pyramiding. You can add to your position as the trend runs in your favour. Or once your trade has run far enough to allow you to move your stop to break even, you can enter trades in other pairs as the opportunity arises.

Intraday trading is much less conductive to pyramiding.

* Trading from daily charts eliminates the need to sit in front of your computer at night, watching the screen. Our night is the European and American business day when most of the currency trading action takes place. Even if you can't look at your daily charts until you come home from work, that's usually OK.....there's usually not much movement during our day anyway.

*Trading from daily charts allows you to easily monitor 10 or so currency pairs. More pairs means more trading opportunities. Intraday, you just don't have the time to monitor that many pairs.

Australian traders are naturally drawn to AUDUSD and AUDJPY. These are OK, but there are other pairs with smoother trends and bigger runs.

The ones I follow are...

AUDUSD

USDCAD

USDJPY

USDCHF

EURUSD

GBPUSD

EURJPY

AUDJPY

AUDEUR

NZDUSD (only recently added this one after noticing that it's put in some good trends and it has a reasonably tight spread, haven't actually traded it yet)

When choosing which pairs to trade, take into account firstly, their 'trendiness' (how well they trend), and secondly, their spread. I won't trade anything with greater than a 5 pip spread between bid and ask. Remember that spread is commission in disguise. The higher the commission, the more it chews into your trading profits.

If you're going to trade from daily charts, I'd suggest that 10 grand is a comfortable amount to have in your trading account. Using a stop of around 100 pips from entry, and trading one mini contract, your potential $100 loss represents just 1% of your trading account, which is ideal. You could get away with a $5000 account, in which case you'd be risking 2% of your account. This is still acceptable, but on some trades you might want to use more than 100 pip stops, which means you'd be violating the 2% rule.

If you trade from end of day charts, look also at 2 day charts and 3 day charts.

Sometimes a valid trade setup will show up on one time frame but not on the others.

Following three different time frames gives you more trade setups to choose from.

Put a longer term moving average on your daily charts, such as 50 EMA, and only trade in the same direction as the slope of that moving average. This is in line with Elder's Triple Screen system that says look at a 13 week Exponential Moving Average (EMA) on the weekly chart to identify the longer term trend direction, then go to the daily chats and find trade setups that signal entries in the direction of the weekly trend. 13 week EMA converts to 65 day EMA (13 weeks multiplied by 5 trading day per week).

I've found that the 65 day EMA is slightly too long for daily Forex charts....50 EMA is better.

As for the news - I completely ignore it when trading from daily charts. I'm a technical analyst working from the premise that the charts give me the information I need to trade profitably. Seems to be working well enough so far.